"If you always do what you've always done, you'll always get what you've always got."

– Henry Ford

To make 2016 your most lucrative year yet, you may have to do some things differently than what you've done in the past.

Here are 15 action items that can put you ahead regardless of what happens with the economy in the coming year and beyond:

1. Become your own CFO.

You can't fix what you don't know, so the first step is becoming completely aware of your finances and where your money is going.

As soon as you start to understand your current situation in detail, you will be able to identify leaks and simple solutions that will help get you on your way.

Nobody cares more about your finances than you do (not even a financial adviser), so it is on you to take control of your financial future and direct it to where you want to go.

2. Go on a diet.

I'm not talking about what you eat. Identify one expense that isn't helping you achieve your goals, and cut it out for 30 days.

A simple expense to choose is cable television. The average American watches more than five hours of TV every day. That is thousands of dollars and thousands of hours often wasted each year!

Try a TV (or other guilty pleasure) diet for 30 days, and use that time and money on something more beneficial. I'm sure you'll survive without it just fine.

3. Be selfish.

When you get on an airplane, what do they tell you during the safety instructions? "Put your own mask on first, and then help the person beside you."

It should be the same way with our time and our finances. Be selfish and take care of yourself first, and then you can have more flexibility to take care of others. The problem is that so many of us put others first and then aren't able to help ourselves.

4. Be selfless.

Although you want to be selfish with your time and money at first, you also want to be selfless with your attitude. The wealthiest entrepreneurs I know give, give, give, and focus on helping others. By doing so, more money shows up in return.

Focus on impact and income will result.

ShutterstockBe willing to help others when you can.

5. Improve your credit score.

Credit is boring and I hate to talk about it, but it does make a difference. Think about it: Most of life's biggest expenses are purchased on credit. It's important to start to take care of it now because there is going to be a situation in the future where you'll wish you had.

The way to improve your credit score again starts with awareness. Get your free report each year from AnnualCreditReport.com and find out if there are any items that are directly hurting your score (which you can get for free at Credit Karma, Credit Sesame, or Credit.com). Address those now and you'll save yourself many thousands in the future.

6. Define what true wealth means for you.

In the dictionary, wealth is defined as "a large amount of money and possessions." However, when you ask someone who is truly wealthy, you get a completely different answer.

As I show in "Make Money, Live Wealthy," the 75 entrepreneurs I interviewed most often shared words like freedom, purpose, family, health, experiences and other things that mean much more than just money.

Money is an important tool that makes all of these other things much easier, but it shouldn't necessarily be the goal in and of itself. Realize this and you will ultimately create your dream life much sooner.

7. Automate your money.

The key with your finances is to make it as easy as possible on yourself. The best way to do this is to automate your finances as much as possible. What this means is that as soon as money comes in, it is dispersed to your other accounts automatically.

For instance, you can set up your finances so that money is taken straight from your paycheck into a retirement investment account, or from your checking account to pay off fixed bills like your internet and cable. The less you can worry about moving your money around and the more you can focus on optimizing it, the better off you'll be.

The key reason why this works is not only to free up time, but it helps prevent us from wasting money. If we see extra money in our account, we'll find a way to spend it and then won't be left with much if any money to invest in ourselves and our future. Automation helps keep our priorities in line and takes the emotions out of it.

Flickr / Foxcroft AcademyFigure out how to earn more through alternate income streams.

8. Add another income stream.

One thing that I learned over and over again from the wealthy this year is that they never rely on one income stream. They have numerous sources, which protect them from changes in the economy and also add up to the greatest numbers.

If you want to make 2015 your most lucrative year yet, your best bet is likely to add another source of income.

9. Focus on passive and residual income.

There is only so much time in the day, so it's hard to build wealth quickly when you're trading your time for money. Instead, the wealthy focus on building income streams where they can get paid over and over again for their work by putting their business or money to work for them.

Examples of this include the investing, owning real estate, running an online business, and writing a book. If you're going to do the work, you might as well get paid over and over again for your efforts. Work hard, but also work smart, and you'll much sooner find the freedom you dream of.

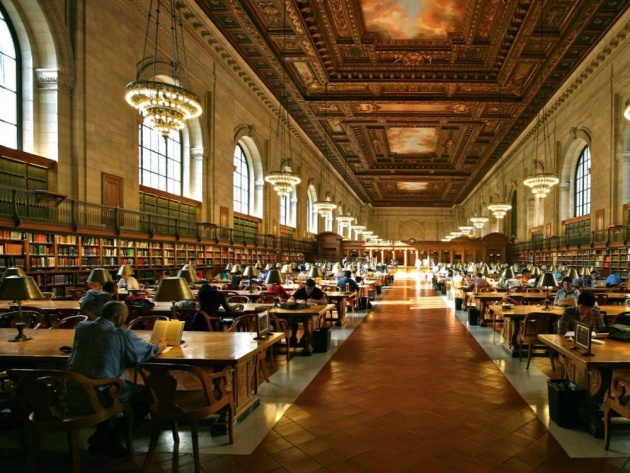

10. Get a library card.

The wealthiest and smartest people in the world have something in common: They're avid readers.

For very cheap or even free, you can get access to the most brilliant and inspiring people of all-time. Investing in yourself is the best investment you can make, and by reading, you are doing exactly that.

Whether it be audio or in print, books have helped change my life and bank account and can do the same for you.

Flickr/Alex ProimosLibrary cards aren't just for kids.

11. Make your investments boring.

Back in 2010 when I started investing heavily, it was exciting. I had multiple monitors continually streaming charts, CNBC, and countless stock prices. This is what I believed that successful investing looked and felt like.

The thing was, I wasn't making any money.

Finally, I started to learn what works and began to take the emotions out of it. When I did, the excitement dropped dramatically (along with my stress) while my results started to shoot upwards.

"Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas."

– Paul Samuelson

12. Track your progress.

It doesn't matter how much money you make. It doesn't even matter how much you spend. What does matter is how much you keep.

Every month, track your net worth (I use Mint.com to do this). This makes you think about the entire picture from income to expenses to investments to taxes. With this focus, you can ultimately make the greatest impact on your finances.

13. Cut out 10%.

Even the most frugal people can find 10% of their expenses to cut. If you then take that 10% and invest it in yourself and in your future via training, paying off debt, or putting it towards vehicles that make you money like investing or starting a business, you'll be much better off.

Try it. Go through your expenses line by line and see what you can cancel or reduce. I do this practice at least twice per year to keep things in line, and I find hundreds in savings each time.

Miles Willis / Stringer / Getty ImagesYour network is your net worth.

14. Hang out with rich people.

Your network is your net worth. Seriously.

As Jim Rohn said, "You become the average of the five people you spend the most time with." It doesn't matter if we're talking about happiness, health, confidence or your income, the people you hang out with are strongly reflected in your own life.

So, if you have one thing on your 2015 to-do list, it should be to raise the quality of your peer group. This will have a domino effect on every other area of your life.

15. Reduce your goals.

Most people don't even create goals, but those that do often go to the extreme and create too many goals. The ultra-successful, however, are great at simplifying their mission and creating a single challenge in front of them at any given time.

As Gary Keller talks about in the great book, "The ONE Thing," the way to get more is to focus on less. Less distractions, less stress, and fewer goals lead to more income and a better lifestyle.