Basics of Investing: Eight Lesson - Creation of Investment Portfolio

Photo credit: Amber255 via Bitlanders.com

Greetings. If you read my blogs, you know that I have started a series about the basics of investing. I wrote already seven lessons for those who, like me, never studied any subtleties of investing in any university, but still, want to care about his own future and is thinking about money investing. I write for those who understand simple language without many terms and numbers. In my previous blogs, we already learned about different investment vehicles, about the risk we can accept, and expected profitability of different types of investments. Now, it is time to learn about the creation of investment portfolio. So, let's start.

Each craftsman has a toolbox that holds out his work tools. The better the master is, the more carefully he chooses the tools. With one experienced craftsman, you will find several different screwdrivers, drills, turning machines, and for the other one, it is enough to have one hammer with nails. An investor is like that master, only a personal investment portfolio is served him, instead of the toolbox. The investment portfolio consists of various investment vehicles: stocks, bonds, money market instruments, raw materials, investment funds, etc. When combining different financial instruments, the investor tries to create the investment portfolio that best suits his or her needs. In particular, the primary goal of every investor should be an optimal investment portfolio.

How to Build an Investment Portfolio

Video credit: Morningstar3TopTips via Youtube.com

A personal investment portfolio can be compared with your own car: a young and risk-free person chooses a fast car, the middle-aged - slower and more comfortable, and even older - emphasizes safety. What is a personal investment portfolio? Who needs it? What is the best composition of your investment portfolio for you? What is the optimal investment portfolio and how to manage it? You can answer these questions by reading my new blog.

While reading my new blog about the creation of investment portfolio, don't forget to check QUERLO CHAT:

What Is An Investment Portfolio?

Many who have heard this word can imagine a standard portfolio of work, which includes a lot of documents. Sometimes we see in movies that people carry a lot of money in their portfolios. In essence, this definition came from the fact that earlier shares, bonds were paper documents, which indicated that I, the investor, have a certain share of bonds and stocks. People used to put all those securities in a portfolio and kept them there.

But today, the whole investment world has switched to electronic form, and most investment vehicles are reflected in the securities account. You see the corresponding electronic records there.

Investment Portfolio Types - Photo credit: wiki.praxeme.org

When we are talking about a portfolio of investments, we are actually talking about a particular pie, which is allocated to certain measures. As a rule, most people invest money in stocks and bonds. This investment portfolio, this pie, can be made up of two parts. In addition to these, there may also be raw materials, gold, and real estate.

Investments consist of a lot of different pieces and put all of them together, so we get a common portfolio, that suits us.

When I talk about the investment portfolio, I always have in mind what it consists of - what kind of asset classes and what part it occupies.

Investment Portfolio Diversification - Photo credit: blog.naver.com

Investment Portfolio Diversification

First of all, investment measures are grouped into two investment vehicles:

- Safe investment vehicles. It includes cash, bank deposits, money market instruments and short-term bonds.

- Risky investment vehicles. It includes shares, equity funds, real estate funds, gold, raw materials and other alternative investment instruments that are characterized by much higher volatility.

When I talk about specific strategies for investment portfolio allocation, first of all, I talk about how much of the portfolio should be focused on safe investments, and how much of it can be focused on risky investment vehicles. And then we can already make each of these two investment vehicles break down into more specific asset classes. But the first step is to break down the portfolio into two parts - risky and safe.

Investment Portfolio Diversification - Video credit: WMIsg via Youtube.com

Why we need a widely distributed investment portfolio? We need it for overall portfolio risk reduction.

By distributing our investments, we cut down the maximum possible return, but we lower the risk even more. Sometimes it is said that allocating is beneficial in order to maximize the possibilities of the return. In reality, it is the contrary. The goal of a broad allocation is the opposite - the goal is the fragmentation of risk.

If you manage to reduce your risk without reducing your profitability, the breakdown goal is achieved. If reducing the risk you manage to increase the profitability, then you shoot two bunnies in one shot, but the overall purpose of the breakdown is to reduce the risk. If reducing the risk, you manage to increase the profitability even, then you shoot two bunnies in one shot, but the overall purpose of the breakdown is to reduce the risk. Distribution of shares and bonds equally, for 50%, is one of the most popular methods of allocation.

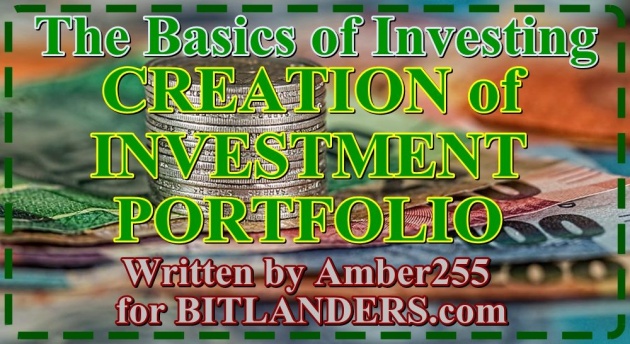

There are distinguished the three main investment portfolios ranked from the safer to the riskiest.

1. The first is called conservative investment portfolio.

2. The second is a balanced investment portfolio.

3. The third one is an aggressive investment portfolio.

Investment Portfolio Types - Photo credit: education.howthemarketworks.com

Let's analyze how the composition of these portfolios differs and what kind of investor it is recommended for.

Let's start with the first one:

1. Conservative Investment Portfolio

The goal of the conservative investment portfolio is to protect the money from depreciation and earn around what is the pace of inflation. Such an investment portfolio invests the largest part (approximately two thirds) of the total package into safe investment vehicles: money, deposits, and short-term government bonds. However, in order to achieve at least a slightly higher return than inflation, the part (about one third) of the investment portfolio can be invested in risky assets: shares, raw materials or real estate.

Conservative investment portfolio is recommended for the people at an age of 60 years and over, for those who can invest money only for less than 5 years, and for those who cannot accept big fluctuations in the value of an investment. The short-term losses should not exceed the 10-15% in this kind of portfolio.

Let's look at a more detailed analysis of the conservative investment portfolio. So far, I have said that 70% of the overall portfolio should be invested safely, and 30% could be invested risky. How would you like to allocate that 30 % for risky investments? The proposal could be as follows: half of that part, about 15%, invest in shares, and the remaining 15% break down into two parts. Then 7.5% goes for real estate and 7.5% to raw materials (specifically gold).

Credit: Amber255

This portfolio provides security. Its value varies little enough. 30 percents of risky investments mean that you earn a little more than inflation, but the bigger part of the portfolio is invested safely and ensure stability.

Investment Portfolio Types and Diversification - Photo credit: somnathpalblog.wordpress.com

2. Balanced Investment Portfolio

The goal of the balanced investment portfolio is a stable investment growth in the long run. This portfolio is usually split in half. Half is allocated to the safe investments, the other half - risky. It is recommended for those people who can invest money for 5 or 10 years, to the people with an age of 40-60 years, and those who are ready to accept higher value fluctuations.

Short-term losses can reach 20-30%.

50 percent is assigned to secure instruments - usually government bonds. Another 50 percent is directed to risky asset classes: 25% invested in shares, 12.5% in real estate, and 12.5% in the raw materials or gold.

Credit: Amber255

Half of the portfolio generates fixed income from bond yields, while another part helps to earn more by investing longer: equity earnings growth, dividends paid, real estate rental income, increase in property value. A small part of about 10% invested in gold is to protect against high inflation. At the same time, fluctuations of this part are difficult to predict and reduce the overall portfolio risk again.

Balanced Investment Portfolio - Photo credit: multiviewblogs.wordpress.com

The goal of the aggressive investment portfolio is to maximize accumulation over a very long period of time. What makes this portfolio? The biggest part is invested in risky asset classes, risky instruments: stocks, real estate, raw materials. Seeking at least minimize the risk, part, about one third, is nevertheless directed to safe means.

Such portfolio composition is generally recommended for young investors aged 20 to 40 years and their investment period is more than 10 years. It would be advisable to invest money for 20 or more years old. To those, who in the short period, during the year, can bravely tolerate 40 - 50% losses from the peak. To those whom such losses would allow a quiet sleep.

About 30 percent goes for safe investments - deposits, government bonds or bond funds, while 70% is assigned to risky investments. This 70% we divide into three classes of assets: shares, real estate, and raw materials. Approximately half of the risky investment amount, 35 percent invest in shares and the other 35 percent we divide to the real estate and raw materials.

Credit: Amber255

A large proportion of risky asset classes can lead to significant price fluctuations, but we can expect higher returns over the long term when we take the higher risk. But the secure part of 30% protects against extreme fluctuations. The allocation of 30 percent in safer investments should reduce overall losses to around 50%. However, choosing such a portfolio, you will not avoid short-term losses, so a similar distribution is worth investing in a really long time- 10-20 years.

It will be ideal if having additional shocks, you would have the extra money to replenish your investment portfolio at that time.

Aggressive Investment Portfolio - Photo credit: twitter.com

How Are Managed Investment Portfolios?

As can be seen, having investment objectives, it is not difficult to distribute proportions how the investment portfolio should be broken down. Once you know for what period you can invest, what risk you can tolerate, it should not be difficult to choose one of the available three main portfolio options. Such portfolios are sometimes referred to as passive portfolios. You choose a portfolio and invest in your savings, according to the specified proportions.

For example, in the case of a conservative investment portfolio, we assigned 70% to a safe investment, and there some variations about 65-75% are possible. Minimum deviations do not affect much. But always keep investments around that framework. If the age, the investment period, and risk tolerance changes, then you change the composition of the portfolio.

Otherwise, once a year, you check the composition of the portfolio, its deviations. For example, if the share price has risen sharply, and the part of the shares in the portfolio has increased significantly, or something has fallen in price, and the proportions of portfolio composition have changed again, then your goal is to restore investments to the original proportions, to draw up them at the limits you have set.

Investment Portfolio Managment - Photo credit: smartomorrows.in

On the Final Note

Each investor, in order to start going in the right direction, should, first of all, choose which long-term investment strategy is best for him. By doing this, he can form a widely broken down global portfolio of investments, and this is best done by choosing liquid and transparent stock exchanges that track specific indexes with the highest amounts managed and the lowest management fees.

What have we learned?

- When we talk about an investment portfolio, we are talking about a whole set of investment measures available to you. The instruments are distributed among the different classes of assets, and the whole creates the investment portfolio.

- Most commonly, there are three main investment portfolio types by allocation: conservative, balanced, and aggressive.

- If you answer the main questions: what are your investment goals, the time period, the risk tolerance, and choose one of the three main potential portfolios, you will immediately choose the right solution - a portfolio that fits into your as investor profile, your goals, reduce the problems that may arrive later, and the probability of errors.

- The investment portfolio diversification balances the risk of the investment portfolio.

Investment Portfolio - Photo credit: blog.tosanboom.com

In this blog, I have just reviewed a small part of what actually we should know before starting our investment journey. It is a complex process that will require from you a lot of practice and knowledge. It is very important that each investor correctly develop the strategy and has the determination and patience to follow it. Only then can one expect a positive return. I hope that this modest guide to the world of investment management has at least slightly expanded your baggage of investment knowledge.

And for the final, one advice: No matter who gives advice, always think by your head, because investment is yours and you only accept the decision, and you will be solely responsible for the consequences or results. Well, do not be investors who believe that if everyone buys shares of a particular company, then I will buy it, this strategy often fails. Therefore, I encourage investors to be interested in, learn and be curious, and then the investment results will meet your expectations.

Invest Money- Photo credit: catalystinvesting.org

The outcome of the portfolio will depend heavily on responding to market developments, from your experience, knowledge, intuition, and talent. I wish you not to stay on the spot and constantly improve - then you will certainly achieve your goals. Good luck!

*************************************************************************************************

Thank you for stopping by and reading my blog.

2018, All Rights Reserved.

You are very welcome to join Bitlanders and share your valuable knowledge and opinion.

***************************************************************************************************

You can check my other blog about investing:

1. The Basics of Investing: First Lesson - What is Money Investing?

2. The Basics of Investing: Second Lesson - Profit and Risk

3. The Basics of Investing: Third Lesson - Bonds

4. The Basics of Investing: Fourth Lesson - Stock

5. The Basics of Investing: Fifth Lesson - Investment Fund

6. The Basics of Investing: Sixth Lesson - Alternative Investment: Real Estate

7. The Basics of Investing: Seventh Lesson - Investing in Gold, Oil, and Other Raw Materials

Come back to find more...

**************************************************************************************************