How to measure the performance of company

(Image source: Google)

Why we need to evaluate the performance of company?

(Image source: Google)

(1) To invest in Business or not

(Image source: Google)

(Image source: Google)

Evaluation is important when we want to invest in company by mean of purchasing their share. For taking decision you must ensure that company has good reputation, good ethical stance, good management and also ensure that company financial position is good so that they can pay you return.

(2): should I lend money?

(Image source: Google)

(Image source: Google)

Lend money to company or not? Will company be able to pay back my money along with interest during these periods? For taking such a decision, you have to see whether company will be able to generate cash to pay back the amount .how risky it is to provide fund.

(3) Security of investment

(Image source: Google)

Banks and other financial institution must evaluate the performance of company before lending money or deciding to extend their credit limit so that to ensure that their investment are secure.

(4): Improve performance:

(Image source: Google)

Company itself evaluates the operational and financial performance to see current position of company, identify the trend from previous year, reason of changes and finally report tends to improve performance.

Types of performance evaluation

(Image source: Google)

1) Operational performance evaluation

2) Financial performance evaluation

Operational Performance evaluation

Operational performance evaluation ensure how well your company is performing, for this purpose you need to obtain evidence to measure with objective of company. Evidence could be quantitative

such as measuring customer traveling times and qualitative such as customer satisfaction.

Operational performance can be measure with the help of different modes. Some of them are following

• SWOT analysis

• Porter five forces

• Porter diamond

SWOT analysis:

(Image source: Google)

This model use to evaluate the current position of company by analyzing the strengths, weaknesses, opportunities and threats faced to it.

SWOT analysis concentrate on both external and as well as internal.

Strengths and Weaknesses

The strengths and weaknesses determine:

› What is the organization good at?

› What is it poor at?

› Where resources are in short supply?

› Where are resources excellent?

› What do you do that your competitor cannot do?

Opportunity and threats

Opportunity and threats determine:

› How company will effect due to change in external environment.

› Whether has ability to use the modern technology?

› Chance for the new entrant to enter into mark et?

› Can powerful customer prescribe terms?

Usefulness of SWOT analysis:

• SWOT analysis is a huge model focused on the current situation of an entity covering vast models in both internal and external to the organization.

• SWOT analysis can identify potential strengths and weaknesses to an organization to cover them adequately.

Limitation of SWOT analysis:

The problem with this model is its highly general nature. Moreover, it gives rise to the tendency to create large lists of an organization’s environmental factors but does not address how to manage these factors. For instance, it cannot advice how weaknesses can be overcome? Or, how likely are the threats to materialize? And to what extent will they affect the organization?

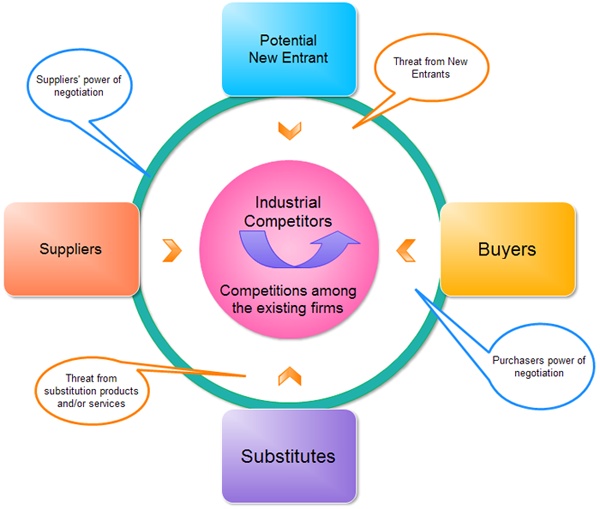

Porter’s Five Forces

(Image source: Google)

The Porter’s five forces framework is superior to SWOT in a way that it looks into the competitive environment in much more detail, although, it does not analyze the macro-external environment or the internal environment.

According to Michael Porter (1985), the potential for profitability in an industry is shaped by the relative strengths of the following five forces;

• New entrants bring new competition into the industry and undermine the profitability of incumbent firms. However, barriers to entry make it difficult for new firms to gain initial foothold in an industry. The lower the barriers, the more attractive the industry is for new firms;

• Powerful suppliers can force businesses to agree to their terms, which might translate into reduced margins for businesses;

• Customers can force businesses to provide products at cheaper prices or improve quality, which squeezes the margins of businesses;

• Substitutes can indirectly increase competition in an industry, or can put a cap on the maximum price that a business can charge its customers; And,

• The higher the rivalry, the lower the profitability of companies, and less attractive the industry is for new entrants

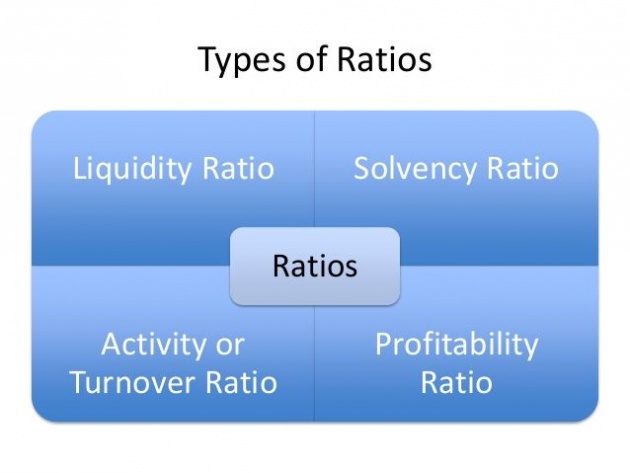

Financial performance measurement:

Financial performance could be measure by using Ratio analysis.

(Image source: Google)

Ratio analyses are analysis used to obtain the indication of financial performance of company in some important areas.

Usefulness and limitations of Ratio analysis:

Usefulness:

Financial ratios simplify the complex financial statements into percentages and times which aid user to understand the information easily. Ratios help in benchmarking companies irrespective of their sizes and to analyze the trends in company’s performance over a period of time.

Limitations:

Ratios sometimes miss important information which skips due to the simplicity.

This analysis is mainly based on historic figures and become useless with the pace of time and change in economy, decisions based on such data can be off beam.

Different companies use different accounting methods, assumptions and estimates which make the comparison uncertain and misleading.

Ratios ignore external environmental factors and conditions which are crucial for a company as much as the internal financial factors

Ratio analysis includes:

(Image source: Google)

Profitability ratio:

(Image source: Google)

This ratio indicates the ability of company to generate profit by effectively utilizing their assets.

Profitability ratio includes:

Gross profit margin means gross profit and sale proportion and can be calculate as follow;

Gross profit margin = Gross profit

Revenue

Net Profit margin = Net Profit

Revenue

Return on Capital employed = Profit before tax

Capital employed

Capital employed = Equity + long term liabilities

A company having high this ratio will indicate that they are generating good profit by using their resources. Lower ROCE ratio means that ineffectively utilizing their asset to generate profit.

High gross profit ratio mean company revenue is higher and cost of sales is low. High this ratio indicate good performance lower ratio indicate either sale price are low or cost of sale are high.

High net profit means that company has control over expenses or we can say that company revenue is much enough to recover all expanses.

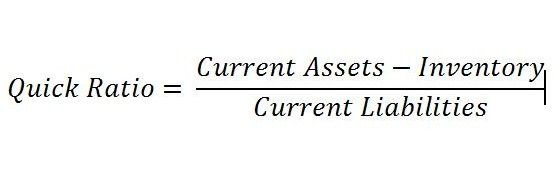

Liquidity Ratio:

(Image source: Google)

This ratio indicates how much cash in hand company held to pay their day to day expanses, wages etc.

A profitable company some time field to exist due to lack of cash in hand. Low profit company but have enough cash in hand to pay their expenses can survive but large profit making company but no cash in hand failed.

Liquidity ratio includes:

Current ratio: = Current assets/current liabilities

Quick ratio = Current assets- inventory /current liabilities

(Image source: Google)

(Image source: Google)

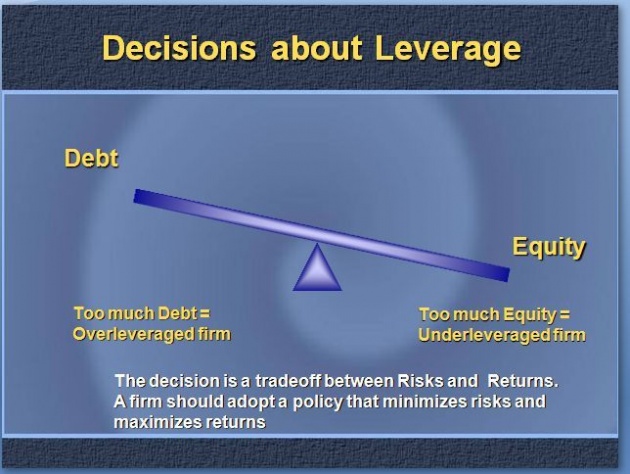

Solvency ratio:

(Image source: Google)

In this ratio we are going to find that how much company has borrowed and how much invested by owner called equity. Higher the ratio indicates that company is highly geared by debt thus high level of risk associate. Debt to equity ratio shows us how much company assets are available to pay $1 of liability, for example if a company has 3 debt to equity ratio mean that company has $3 of asset for paying liability of $1.

We find this to ensure that company is not too much risky by taking too much debt and having low amount of equity. Too much debt means that company is running by lending money thus finance cost will high, also risk of paying back will high.

To calculate the level of debt and equity the following formula use

Debt to equity: Total Debt/long term liabilities.

Investor Ratio:

(Image source: Google)

Price /earnings ratio:

This ratio indicate us how much an investor is ready to pay for dollar 1 of earning which is reported in statement of financial position of company. Greater the ratio show that share holders are willing to pay more for earning $1 of reported return and vice versa.

conclusion

(Image source: Google)

When we have to measure the performance of company or individual business for the purpose to invest in them, to lend them money, to work for them or for any other purpose we have to measure the performance. To appraise the performance we have to see their operation performance such as Quality, strengths, resources and capacity etc. This operational performance can be appraise vie SWOT analysis, porter five forces etc. also we have to see the financial performance which can be obtain from using ratio analysis. After evaluating both we would be able to decide whether to go ahead or to move to next opportunity.

(Image source: Google)