The Basics of Investing: Seventh Lesson - Investing in Gold, Oil, and Other Raw Materials

Photo credit: Amber255 via Bitlanders.com

Greetings my readers, you are welcome to my new blog about the basics of investing. I have written already about investing in stocks, bonds, real estate, and now it's time to talk about investing in raw materials or otherwise, investing in commodities. Investing in gold, oil, and other raw materials intriguing many of us. Almost everyone dreamed of having a gold mine or an oil well. And everyone needs a gold and oil, so you'll always find out to whom to sell it. And even better, the price of raw materials, in the long run, is constantly growing due to limited resources. The good news is that you do not even need the gold mines or an oil well to take advantage of the raw materials increased value. It is true that investing in gold, oil, and other diverse commodities have their own subtleties.

We deal with raw materials every day. We drive to the cafe using fuel, we buy coffee in a cafe, add sugar to it and mix it with a metal spoon. All of these raw materials are bought on the commodity exchange. Raw materials prices have been having a major impact not only on ordinary people but also on the economy as a whole. For this reason, we are constantly hearing about food and fuel prices from the press, television, and other mass media. Due to constant demand, limited supply, and influence on the economy, raw materials are also of interest to investors.

So, let's talk about investing in gold, oil, and other raw materials. If you want to know why investors invest in gold, silver, various other metals, oil, and other raw materials, how to buy them, why the price of raw materials is changing, and what the risks are to be assumed, this article is for you.

Investing in Commodities: how and why? - Video credit: FinancialTimesVideos via Youtube.com

What is Investing In Commodities?

Raw materials or commodities are marketable products that do not have qualitative differences, for example, the gold is gold everywhere, natural gas is a natural gas everywhere, so there is not really a difference where and from whom you buy it, but you still get the same raw material. Because raw materials do not materially differ, they can be traded on exchanges. Gold, oil, food and other commodities are traded on specialized commodity exchanges.

To allow raw materials to be traded on the commodity exchange, there is a need for market participants' agreement on common standards for the marketing of raw materials.

The commodities exchanges trade in specified quantities of raw materials, for example, the Gold trading standard is 1 troy ounce. For example, an investor on the exchange purchasing 5 gold contracts is actually buying 5 troy ounces of gold.

Credit: Amber255

On the other hand, to say that raw materials have no qualitative differences would be erroneous. Raw materials have many qualitative levels and the best raw material quality, the more expensive it is sold. At the commodity exchanges, the most active trade is in precious metals and energy resources: gold, silver, crude oil, natural gas, but other sectors of construction and the food industry are also the most popular: iron ore, aluminum, ethanol, coal, sugar, salt, coffee, soya, rice, and wheat. However, there are many more raw materials traded on commodity exchanges.

Investing in Commodities - Photo credit: naunlemos.blogspot.com

All raw materials could be divided into five categories:

- The raw materials of the energy sector - oil, natural gas, uranium, propane.

- Metals are divided into precious metals such as gold, platinum, palladium, silver; and industrial metals such as zinc, aluminum, nickel, steel, and the like.

- Livestock production - sheep meat, pork, and live cattle.

- Agriculture products - maize, rice, soya, cocoa, coffee, sugar, cotton, etc.

- Other raw materials - ethanol, rubber, wool or polyethylene.

Raw materials trading is essentially beneficial for the sale and purchase of raw materials by large companies. The companies on a commodity exchange provide the supply of raw materials, and they make contracts to buy and sell raw materials in the future.

Investing in Commodities - Photo credit: dondeinvertirsudinero.wordpress.com

Is it Worth Investing in Raw Materials?

Investments in raw materials occupy part of the investor's portfolio. There are several reasons for this:

- the cost of raw materials is rising up in the long run;

- the value of raw materials does not diminish due to inflation;

- investing in raw materials is a good tool for risk management and is probably the best instrument for diversifying the investment portfolio.

Investments in raw materials, in the long run, are similar to bonds. In the long run, raw materials provide 5% return on investment. It is important to note that this indicator is based on changes in the price of more than a hundred different raw materials.

Alternative Investment way - Investing in Commodities - Photo credit: https:/twitter.com

No less important is diversification. Raw materials, unlike stocks or bonds, are tangible assets. For this reason, the cost of raw materials is different in response to economic ups and downs. As a rule, as the economy shrinks, the value of the stocks starts falling, but the price of raw materials remains unchanged. In general, analyzing past data shows that investment in raw materials correlates little with the traditional investment vehicles. This property of raw materials is important for investors seeking diversification of their investment portfolio.

While reading my blog about investing in commodities, please check Querlo Chat:

Investments in raw materials are resistant to inflation. When the demand for goods and services increases, their price also increases. In order to produce more goods, more and more commodities are needed. Increasing demand for commodities also raises the price of raw materials. As the price of raw materials increases with inflation, investors can use the raw material as an inflation risk management tool.

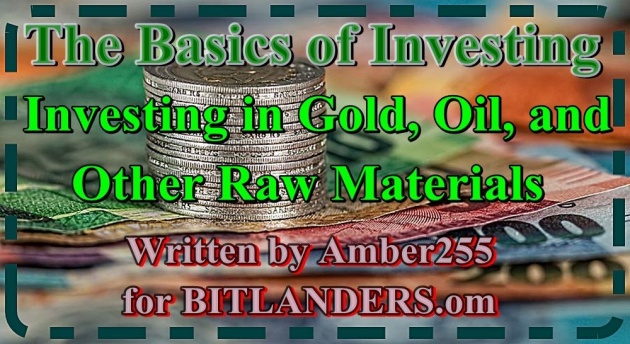

Investments in commodities are based on future contracts. However, financial institutions have simplified investment in raw materials. Investors can invest in commodities using derivative instruments. Now, investing in raw materials is possible through the purchase of futures contracts, stocks, ETF funds, direct investment and index funds. What instruments an investor will choose depends on his knowledge, experience, and risk tolerance.

Commodity Exchanges - Photo credit: tolitasmusings.blogspot.com

Factors That Affect the Price of Raw Materials

The price of raw materials depends on demand and supply. Raw materials, unlike securities, are scarce resources, and the scale of raw materials production is not dependant on demand. For example, the world's oil is extracted from existing oil extraction platforms, the amount of gold extracted depends on the amount and capacity of the exploited quarries, and the amount of wheat depends on the area under cultivation and fertility.

The supply of raw materials is limited, so their price is most affected by demand. As demand rises, the cost of raw materials increases.

The raw materials'supply may also decrease.

For example, for political reasons, oil production can be reduced in the world. Despite the fact that there would be less oil extraction in the oil world, there would be no reduction in demand for oil. So, in fact, the same amount of potential buyers is competing for a smaller amount of oil. Buyers offering the higher price are buying oil, and the rest are left without anything. So the price of oil is rising.

Credit: Amber255

The price of raw materials is more robust to economic cycles than securities, as some commodities suppliers in organizations can control the amount of raw material they produce. The cost of farming and livestock raw materials can be heavily influenced by weather conditions or natural disasters.

Prices of Raw Materials - Photo credit: youtube.com

Investing in Gold

The easiest way to invest in raw materials is to buy and store them. Of course, you might not be able to store 100 t of oil or 1t cereals, but you can buy precious metals such as gold, silver, palladium or platinum. Precious metals are relatively liquid. Investing in gold is perhaps the most liquid one. Nearly half of the world's gold reserves are kept as reserves. Gold stocks justify the value of the currency and give the stability of the currency, so people in all parts of the world understand the value of gold, and it's easy to sell.

In recent years, gold has received a lot of interest. This interest, of course, was higher by the end of 2011, when the gold price reached $ 2,000 per the 1troy ounce. Lately, the price a bit went down, but gold is an interesting alternative investment way, which every investor should evaluate.

10 Reasons Why You Should Invest In Gold And Silver - Video credit:

AztecGoldSilver via Youtube.com

What Should We Know About The Gold?

Most investment experts believe that it's very difficult to say exactly what affects the price of gold. If we invest in bonds, we can expect to be paid an interest; when investing in shares - we can expect profit growth, dividend payments; investing in real estate, we can expect rental income.

By investing in gold, we can expect that by buying at one price, we may sell it at a higher price. Gold does not generate income, so the only thing that can bring benefits - an increase in price.

Who can determine that? As always, so in this case, we are dealing with inflation. In the long run, with the increase in money supply and its amount, or, in other words, depreciation of the money, the price of gold should increase accordingly, because its outputs are small and its quantities are quite limited in the world.

Investing in Gold - Photo credit: fisicamoladivertida.blogspot.com

But what determines price fluctuations in the short term is very difficult to say. At one time, political events can have a positive effect on prices, and at other times, negative. The price of gold can rise as stocks become more expensive, even when the stocks go down.

In general, we can say that investing a part of our total portfolio in gold, we can significantly reduce the overall total risk of the investment portfolio. Eliminate the risk. This is explained by the fact that the gold price movement is hard to predict comparable to others asset classes.

How Did The Price Of Gold Change The Last 200 Years?

Gold was found a long time ago. For a long time, it performed the money function - there were gold coins. After the paper money was invented, gold acted as surety. And only last 40 years, most currencies are uncoated by gold, and the price of gold is freely fluctuating.

Until about 1970, the released currency should have been covered with gold, and the central banks should have a gold reserve to release the dollars or other currencies. The price of gold was enough stable, and inflation was lower throughout this period. Since 1970, the gold price has been allowed to fluctuate freely and, over the last 40 years, the average annual return on gold has been around 9%. However, if we analyze for a very long time, we will see that the average annual gold price return was 2%. Only the last 40 years, the gold was relatively profitable as an asset.

We should invest in gold for another reason - to reduce our overall investment risk.

Invest in Gold - Photo credit: cnbc.com

How To Invest In Gold

- When investing in gold, you can choose one of the two main ways to: invest directly by acquiring gold coins or gold bullions. But you need to know that by investing in this way, your paid taxes and additional commissions can reach 10-20 or even 30% of the price.

- The second is a fairly convenient way - invest in gold investment funds. They can be purchased at banks, or directly through electronic exchange platforms. Such funds usually invest in real gold bullion - exactly reflects the changes in gold prices. But if you want to have a real metal and put it in a safe - this option will not fit you.

How to Invest In Gold - Photo credit: apoorvapatki.wordpress.com

On The Final Note

In the past, only large companies traded raw materials, since raw materials exchanges traded only in large transactions. Nowadays, modern investment vehicles and raw materials trading platforms provide opportunities for small investors to invest in raw materials. You can find the raw materials in investment portfolios of many small investors.

Choosing the gold or other raw materials investments for a long period of time, we can expect returns close to the pace of inflation. Although it's not a big return, the part of the investment in gold quite greatly reduces the investment risk - your portfolio overall fluctuations become much smaller. It would be worthwhile for those, who only invest in stocks or bonds, to consider 10-20% of the share investment portfolio to invest in these alternative investment ways.

Investing in Raw Materials - Photo credit: onsdagsfonden.wordpress.com

Investors who wish to invest in raw materials can choose from a variety of financial instruments: derivatives, currency exchanges FOREX, equities, ETFs, investment funds or just buying the raw material itself. All of these investment methods are differently related to changes in the value of raw materials. Which of the financial instruments is best for you depends on your goals. Remember:

- Trading of raw materials takes place on commodity exchanges.

- Trading of raw materials is based on trading futures.

- The commodity exchange is characterized by drastic changes in value.

- Investing in gold, silver, and oil is the most popular among investors.

- The changes in the value of raw materials do not coincide with changes in the value of the shares.

- Investments in raw materials are resistant to inflation.

- Investing in raw materials helps to manage portfolio risk.

- Raw materials are used to diversify the investment portfolio.

- It is recommended that only a small part of your investment portfolio was allocated to investments in raw materials.

- Investing in raw materials is possible by trading futures, purchasing shares, investment, index, or ETF fund units.

Raw materials are an appropriate risk management tool. They are more resistant to unexpected events, financial crises, and political risks. It does not matter what happens, yet people will need to eat, they will need fuel and metal, etc.

*************************************************************************************************

Thank you for stopping by and reading my blog.

2018, All Rights Reserved.

You are very welcome to join Bitlanders and share your valuable knowledge and opinion.

***************************************************************************************************

You can check my other blog about investing:

1. The Basics of Investing: First Lesson - What is Money Investing?

2. The Basics of Investing: Second Lesson - Profit and Risk

3. The Basics of Investing: Third Lesson - Bonds

4. The Basics of Investing: Fourth Lesson - Stock

5. The Basics of Investing: Fifth Lesson - Investment Fund

6. The Basics of Investing: Sixth Lesson - Alternative Investment: Real Estate

Come back to find more...

**************************************************************************************************