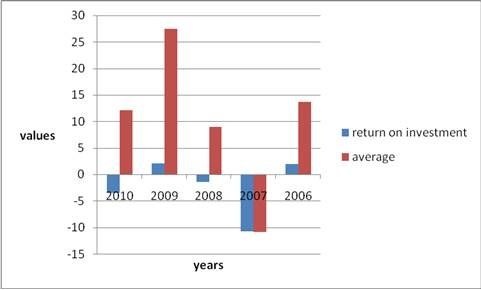

Return on Investment

|

Details |

Unit |

2010 |

2009 |

2008 |

2007 |

2006 |

|

Return On Investment |

% age |

(3.5) |

2.1 |

(1.47) |

(10.72) |

1.98 |

|

Average |

|

12.1128 |

27.408 |

8.9606 |

-10.852 |

13.7288 |

Interpretation:

Return on investment is negative except 2006and2009 this is not good. Return on investment is less than average it is not good.

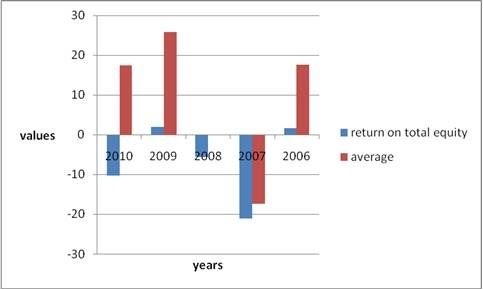

Return on total Equity *

|

Details |

Unit |

2010 |

2009 |

2008 |

2007 |

2006 |

|

Return on total Equity |

% age |

(10.4) |

1.99 |

(5.7) |

(21.2) |

1.67 |

|

Average |

|

17.4914 |

25.8126 |

-0.1662 |

-17.457 |

17.54544 |

Interpretation:

Return on total equity is negative except 2006and2009 it is not good. Return on total equity is less than average it is not good.

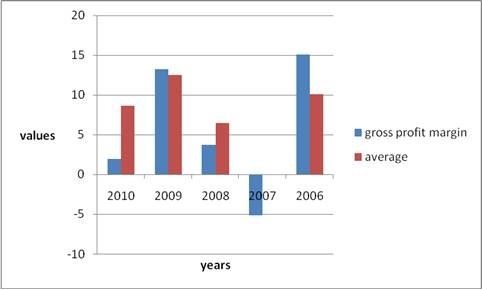

Gross Profit Margin

|

Details |

Unit |

2010 |

2009 |

2008 |

2007 |

2006 |

|

Gross Profit Margin |

% age |

1.9 |

13.2 |

3.67 |

(5.2) |

15.1 |

|

Average |

|

8.6398 |

12.5216 |

6.4158 |

-0.0466 |

10.0748 |

Interpretation:

In 5 years gross profit margin is +ve with a small amount except of2007.now it is decreasing that is not good. Gross profit margin is less than average except 2006,2009 it is not good.

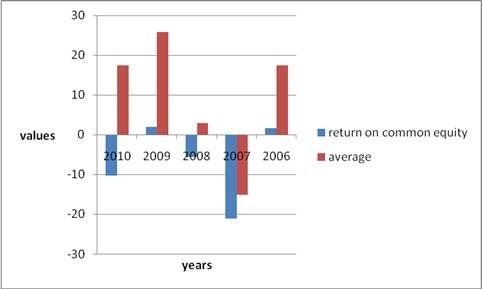

Return on common equity *

|

Details |

Unit |

2010 |

2009 |

2008 |

2007 |

2006 |

|

Return on common equity |

% age |

(10.4) |

1.99 |

(5.7) |

(21.2) |

1.67 |

|

Average |

|

17.4914 |

25.8126 |

2.8738 |

-15.117 |

17.42544 |

Interpretation:

Return on common equity is same to the return on total equity. Return on common equity is less than average it is not good.