Government bonds, Treasury securities are issued by individual countries. A state issues them to fund itself and “lending” them to individual subscribers, who by purchasing these titles receive a coupon payment of interest.

The states, during the life of the security, use the cash borrowed to finance their spending, major construction works and anything for the needs of the state.

Each state has a so-called rating (in future episodes we will dedicate a full explanation to this), a degree of judgment: the higher the interest, the greater the risk. A country less solvent than another is forced to issue securities with higher interest rates to attract investors, and therefore must pay a higher coupon.

The main features are as follows:

- the maturity can change from a minimum of 3 months to a maximum of 30 years

- the coupon interest rate may be fixed for the entire duration or variable rate tied to an index (such as the rate of inflation) .

Broken down by country of issue, the most famous:

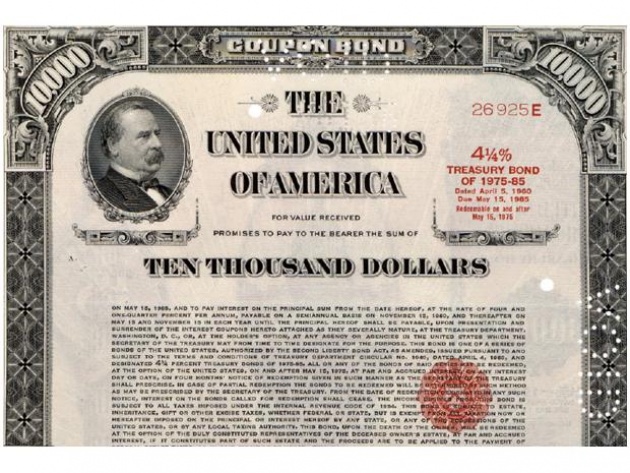

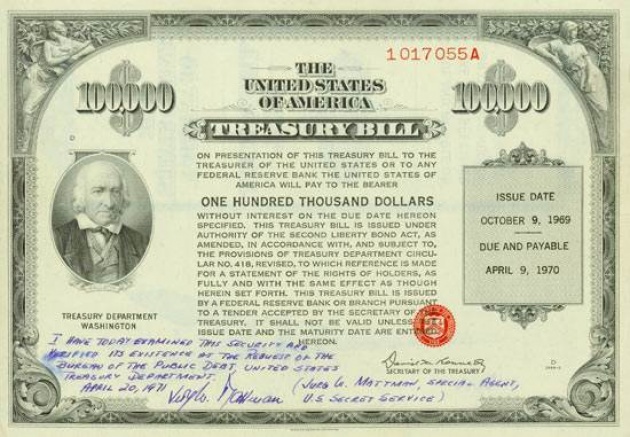

- USA: Treasury Bills, (less than one year), Treasury Notes (2-10 years), Treasury Bonds (30 years), Treasury Inflation - Protected Securities ( linked to inflation ).

- Germany : Bubill, Bundesschatzanweisungen (2 years), Bundesobligationen (5 years) , Bundesanleihen (10 to 30 years).

- United Kingdom : Conventional Gilts, Index -linked Gilts, Double-Dated Gilts, Undated Gilts, Gilt Strips.

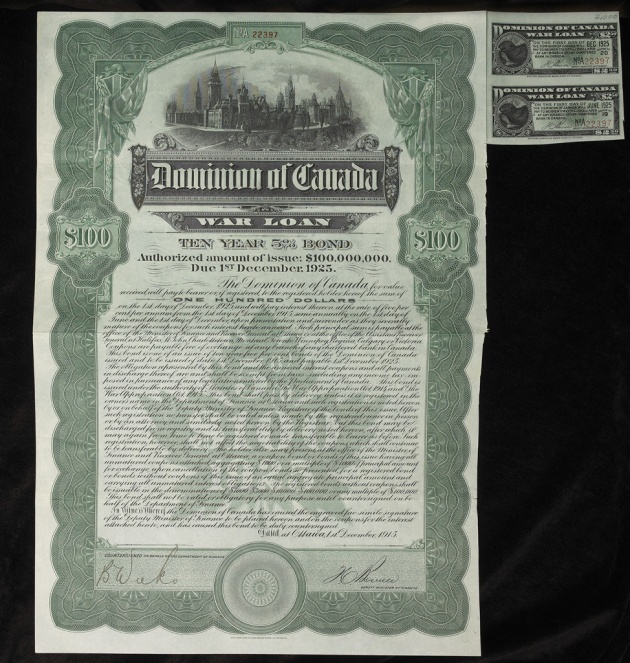

- Canada: Canada Bond (fixed rate), Real return bonds (inflation- indexed) , Canada Savings Bonds, Savings Bond Ontario, Saskatchewan Savings Bond.

- France : Bon du Trésor à taux fixe et à intérêt précompté (up to 1 year), BTAN (1-6 years), Obligations assimilables du Trésor (7-50 years) , TEC10 OAT (variable rate to 10 years) , OATi ( indexed ), OAT€i ( inflation-linked euro area ).

- Spain : Letras Treasury (less than one year), Bonos del Estado (2-5 years), Obligaciones del Estado (over 5 years).

- Italy: BOT (up to 1 year), Certificate Treasury zero -coupon (up to 2 years), Treasury Bonds (5-30 years), Certificate Treasury Credit (up to 10 years floating rate), BTPi (indexed for inflation) .

Soon we will face issues related to corporate bonds and ratings to understand what they mean and the impact in the movement of a state or society.

Until next time ...