Proponents of the digital currency Bitcoin have typically argued that cash created out of coding system may facilitate poor individuals access monetary services. however up to now applications for the technology are nearly completely geared toward individuals with net access and smartphones. currently a South African non-profit-making is making ready to provide the concept its 1st real take a look at.

In the next few months, some immature ladies in poor areas of South Africa are offered the prospect to check out a form of digital bank account operated via text messages. it'll be offered as a replacement feature on a mobile social network service the ladies already use. The savings feature can let individuals earn and save mobile airtime credit, that is employed additionally to government-backed cash as a currency in some countries.

Behind the scenes, the new service is powered by a digital currency referred to as Stellar, that was galvanized by Bitcoin. All savings balances and transfers are painted victimisation stellars, because the currency’s units square measure renowned.

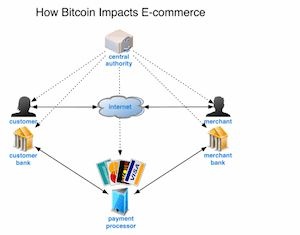

Stellar, like Bitcoin, relies on a system that uses scientific discipline package to make digital tokens that can’t be counterfeited. however Stellar differs from Bitcoin therein it's designed to act as an negotiant between typical currencies and assets, to hurry up transfers between them, and not as a way of payment in its claim. Development of Stellar is being undertaken by a non-profit-making, the Stellar Development Foundation, backed by $3 million from the payments company Stripe (see “Increasing the value of the Internet”).

The Praekelt Foundation develops a chunk of free package referred to as Vumi that powers interactive services that may run over text messages on phones while not knowledge plans. Humanitarian organizations together with United Nations Children's Fund, USAID, and therefore the Gates Foundation use Vumi to deliver health and education schemes in Africa et al..

The new savings feature are offered as AN opt-in feature of existing social networking services engineered on Vumi and geared toward immature ladies living in financial condition, says Gustav Praekelt, the pinnacle of the muse. for many of the ladies it'll be their 1st chance to own a bank account, he says, one thing he hopes can cause higher choices regarding cash.

Tests of the savings service square measure planned for many countries. additionally to South Africa, Dutch East Indies is probably going to be a take a look at market within the next few months, says Praekelt.

The savings feature works by satisfying teenagers with tiny amounts of airtime reciprocally for causing messages, reading things, and doing different activities on the welfare work. +

Because the package that powers Stellar is meant to create it simple for corporations and organizations to quickly and firmly transfer a reimbursement and forth, Praekelt says it eventually may become a framework for a lot of refined monetary services. for instance, governments or aid agencies may use Stellar to deliver payments to individuals, maybe to reward participation in specific academic or health programs.

For now, the muse is that the solely organization of any size in public renowned to be creating use of Stellar. Praekelt hopes which will amendment once corporations and different nonprofits see the bank account service in action.

However, digital currencies have nonetheless to examine a lot of take-up from typical monetary establishments or corporations anyplace within the world. Kentaro Toyama, An prof at the University of Michigan , says that though Stellar will create it easier to create new monetary services for poor individuals, it'll still have to be compelled to win the approval of regulators.

Most countries’ monetary rules create it tough for corporations that aren't banks to transfer and store cash, typically permanently reason, says Toyama. that may be a haul for organizations making an attempt one thing new, like providing savings or transfer services on mobile devices. The success of Kenya’s M-Pesa mobile payments system, an advertisement kid for innovation in mobile cash, illustrates the purpose. it had been solely created attainable once the wireless carrier Safaricom got special approval from regulators, says Toyama.

Source