Video Credits: Philippine CPA via YouTube

Image Credits: Sharon Lopez via Bitlanders

One way of encouraging business-minded individuals to pursue a business in a certain place can be dependent on several factors. The opportunity of growing, the capital requirements and the ease of doing business.

Image Credits: 889520 via Pixabay

On its latest post, the Business World shared that the Philippines is among the most improved countries in the global competitiveness index. Being able to get the 56th place among the 140 countries included on the list. The global competitiveness index measures the productivity level of the different countries in the world.

Image Credits: flickr.com

This only shows that the government is continuously implementing laws and regulations as well as programs in order to achieve economic development which will benefit the whole country.

Image Credits: Geralt via Pixabay

In today's post, I will be sharing with the process of securing tax clearance which is one of the requirements for securing a Platinum PhilGEPS Registration which is of utmost importance when transaction business with a government entity. When we say government, it could be from the Barangay Local Government Units up to the office of the President. I hope you find helpful information through this post.

WHAT IS TAX CLEARANCE?

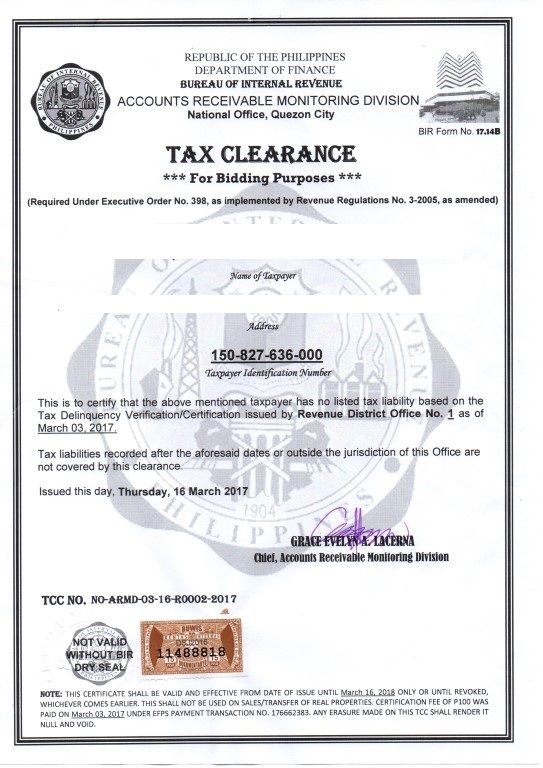

Image Credits: Venvi.com

A Tax Clearance is an official document issued by the Bureau of Internal Revenue (BIR) in the Philippines. It is commonly requested by the taxpayers or businesses used as a verification to the investors or clients that the business is tax compliant or of good standing. This is also a required document to apply for government tenders or render particular services. Source

In my recent blog post, I mentioned that one of the requirements for obtaining a PhilGEPS Platinum Membership is a tax clearance. If you missed that post, you can check it from HERE.

Obtaining a tax clearance is one of the most daunting tasks one could encounter when applying for the PhilGEPS Platinum membership account. This is based on the statement of some business owners in our place. The reason is those business owners from different provinces has to travel all the way to Manila to secure the clearance.

However, the recently passed Revenue Regulations No. 18-2018, amended the old provision of Revenue Regulation No. 8-2016 which allows the processing and issuance of the Tax Clearance as required by RA 9184 or the Philippines Procurement Law at the Regional Level where the business is registered. This move from the Bureau of Internal Revenue (BIR) will help in facilitating the issuance of Tax Clearance which is one of the mandatory requirements for the release of the Upgraded PhilGEPS Registration to Platinum. Ultimately, such action from the BIR will help the government in its implementation of the program, The Ease of Doing Business.

Related Post: Why Doing Business With the Government Can Be a Good Idea

REQUIREMENTS FOR SECURING A TAX CLEARANCE CERTIFICATE

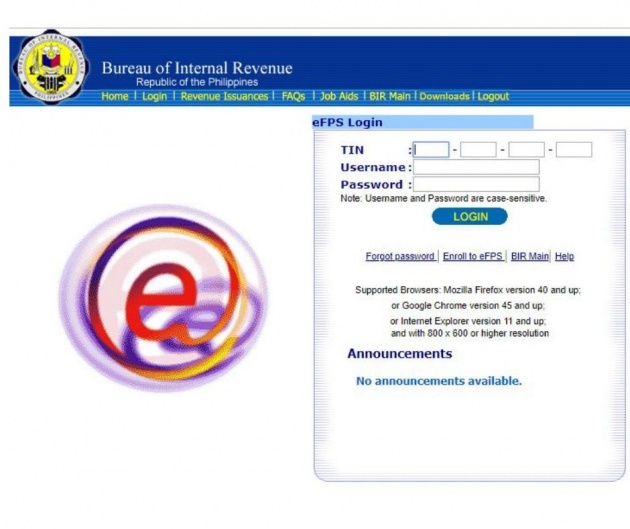

➤A person requesting for Tax Clearance must be a registered member of eFPS

Image Credits: BIR.gov.ph

To ensure the smooth transaction, please see to it that you already registered through the BIR Electronic Filing and Payment System (eFPS). If not yet a registered member, go to your Revenue District Office (RDO) so that you may be able to pursue with the enrollment process. Make sure you have the following documents with you:

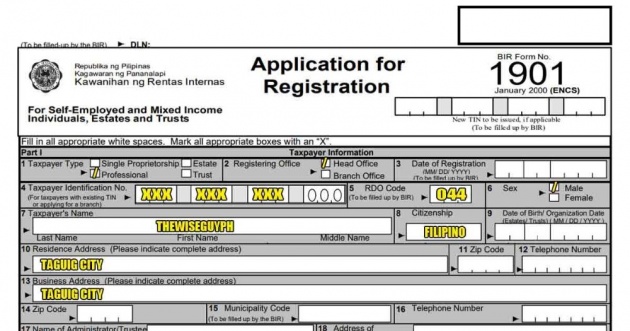

➤Certificate of Registration (COR)

Image Credits: TheWiseGuy.ph

➤Letter of request for the enrollment in the eFPS. include two (2) authorized users with the following details: name email, contact number, and position.

It is also important that you have no prior missed tax payments otherwise you will need to settle these tax overdue including the penalty. To be sure, brig with you the tax payment form and the printed BIR acknowledgment.

➤A written request for tax clearance.

WHAT ARE THE STEPS INVOLVED IN APPLYING FOR TAX CLEARANCE

Image Credits: Sharon Lopez via Bitlanders

1. Go to the RDO in your area and bring the written request for securing the tax clearance and BIR requirements.

2. Your record will be checked by the person-in-charge. Assuming that you have no missed payment, you will be given a Certificate of No Tax Liability. However, if the records show that have some missed payments, you will be required to pay such including penalties.

3. Pay for the Tax Clearance Certification Fee amounting to PHP 100.00 ($2.00) through the eFPS. Attach the eFPS Bank Statement Confirmation Receipt to the Certificate of No Liability and attach the same to the Certificate of No Liability.

4. Go to the Bureau of Internal Revenue (BIR) Regional Office and bring the following documents:

- Certificate of No Tax Liability

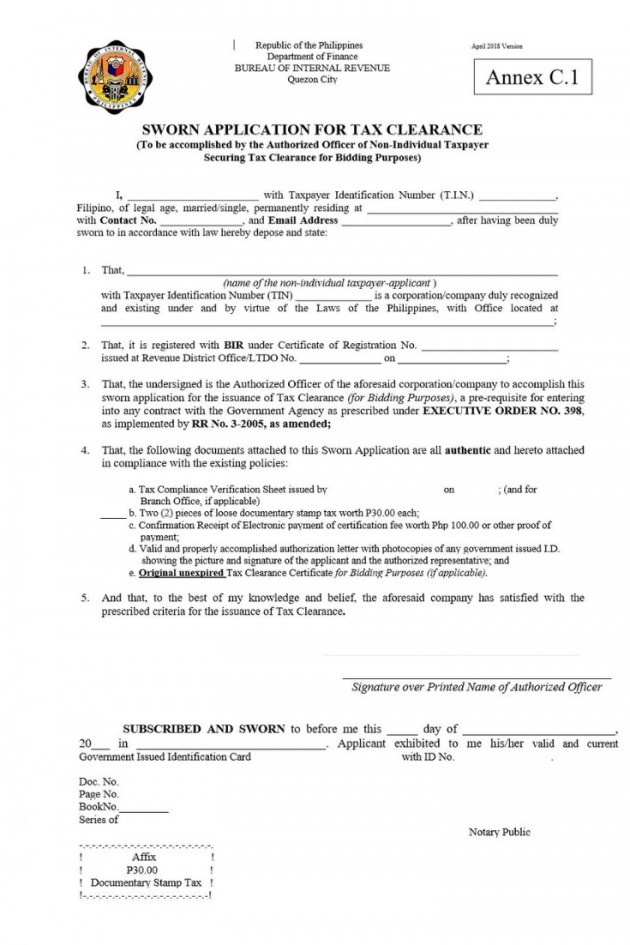

- Application for Tax Clearance which can be downloaded from the BIR Website

Image Credits: BIR.gov.ph

- BIR Form 0605 (Payment Form) and the eFPS Bank Payment Confirmation Receipt for the Tax Clearance Certification Fee

- Photocopy of the Certificate of Registration (COR)

- Previous Tax Clearance issued (if applicable)

- Documentary Stamp (do not affix)

- Letter of Request for Tax Clearance

- Latest Tax Return filed and paid through eFPS from the payment of Registration Fee.

Image Credits: Geralt via Pixabay

5. Wait for the Tax Clearance. You will be called to claim the same.

Note: Make sure to bring the complete documents to prevent delays in the processing of the Tax Clearance.

Here is another video that will guide us in securing documents for our business registration. Hope you find this helpful.

Video Credits: Start-up Business via YouTube

CONCLUSION:

Because of the campaign to encourage people to establish their businesses and to increase revenues, the government is continuously looking for innovations and programs in order to reduce the time allotted for the processing of business certificates and the likes. With the devolution of the processing of application of Tax Clearance at the regional level, the process becomes much lighter to the taxpayers. Thus, many people are encouraged to start a business which will benefit the whole country in general.

DISCLAIMER: The views and opinions expressed in this c-blog post are that of the author and does not in any way represent the agency or department she currently belongs.

ADDITIONAL NOTE: The sites mentioned in this post are for information purposes only and links are provided for easy access. The author does not receive any remuneration from the said companies or sites.

-oOo-

Written for Bitlanders

by ♥Sharon Lopez

Date: February 09, 2019

Visit my blog profile for more ♥BLOG POSTS

Sharon Lopez is the Author/Owner of IDEAL CAREER IDEAS

Want to earn from sharing your opinions through blogging? Join us in Bitlanders and claim your 1 DOLLAR REWARD upon signing up. CLICK HERE TO JOIN