The Basics of Investing: Fourth Lesson - Stocks - Photo credit: Amber255 via Bitlanders.com

Welcome to my fourth lesson about investment - Stock. I hope some of you already got an idea to invest some of your saved money for the better future. Myself, I am asking advice to my mentor which company to choose, and also I am doing researchers myself. Dreams bring colors to life, and money helps to fulfill your dreams. But in order to have money, it is necessary to work hard and sail against the stream, because then you can take more.

This my lesson is intended for those who want to invest in stocks individually, who want to learn how to determine the fair value of shares, to calculate the criteria for the evaluation effectiveness and to compare the shares of companies. So if you want to become an expert on investing in shares, without waiting for anything, start digging into the subtleties of the shares. I am trying to explain everything in very easy terms that it would be understandable even for the starters in the sphere of investment.

Many of you have probably dreamed of having your own business for many times, even have some great ideas about how it should look and imagine what your wealth would be. But business often requires a lot of investment, knowledge, experience, and eventually, you're tied to your company's steering wheel. And still, you can have a business, avoiding all this hassle. I am talking about investment. You will get a profit, and the best part is that you do not even need to go to work.

So, what are the stocks? How to earn money in Stock Market? What kind of return can we expect if decide to invest money in shares of one corporation or another? What the risk do we have to accept when investing our savings in stocks?

What Are Stocks? - Video credit: Investopedia via Youtube.com

What is a Stock?

First of all, let's take a look again at the profitability risk map for all investment types. As I already mentioned in my first blogs about investing, shares are one of the riskiest and likely to be one of the most paying investment types. However, not all shares are equal. The situation is very similar to the bonds. If you have read my blog about bonds, you know that bonds are very different from each other too. However, if you want and you can invest for a long time or you can take a higher risk, overall, stocks are one of the best alternatives. But never forget that stock is a rather risky investment. In the short term, their range of value fluctuations is much higher than bonds.

Stocks are also called "equity securities." So, what are stocks? When you invest in a particular company, you acquire its shares by becoming a co-owner of that company. It is very important to understand that. You must understand that by investing in shares, you become a business shareholder. This means that you are applying for the added value created by that company.

Earn money in Stock Market - Photo credit: wordpress.com

The difference between Share and Stock

Both shares and stock have the same meaning. But there is one difference.

"Stock" is a general term used to describe the ownership certificates of any company, and "shares" refers to the ownership certificates of a particular company. So, if investors say they own stocks, they are generally referring to their overall ownership in one or more companies. Technically, if someone says that they own shares - the question then becomes - shares in what company?

Credit: investopedia.comi

Preferred and Common Stock

Stocks are usually divided into two main groups: common stock and preferred stock. Preferred stocks occur very rarely. The difference between common and preferred stock is that the owners of preferred stocks have a certain fixed dividend percentage. If a company makes a profit, the owners of the preferred stock receive a certain amount of profit. And so every year, when the profit is earned.

Common shareholders usually don't receive dividends in the same way as the preferred shareholders receive, even if the company earns a profit (this would happen if the company decided not to pay dividends in that year). There are other subtleties, but the main difference is this. In this case, the most important thing for us is that the share of common stocks is the highest.

The Sources of the Profit

Before deciding to invest in stocks, it would be worth asking - from what sources I, the investor, can expect to make a profit by investing in shares? In the case of bonds, the main source of investor's profit was the interest (called coupon). When investing in shares, there are two main sources of income.

While reading, do not forget to check Querlo Chat:

The first is the long-term increase in the value of the property, which is mostly determined by the increased profit of the company and, secondly, dividends from that profit. If the company makes a profit, means, manages to sell the product or service more expensive than production cost, this difference is an earned profit. Part of the profit (or all) can be paid in the form of dividends, the other part remains in the enterprise, and a company invests it in its development.

Stocks are Characterized by Big Fluctuations

Shares are characterized by extremely high short-term price fluctuations. As a result, stocks are recommended for young people investors who have long enough investment horizon or those aggressive investors who are not afraid to take risks.

The reason is simple - in economic crisis and recession, the value of shares can fall by 30, 50, 70 or even more. This means that it may happen that if you invest $10,000 you will incur a loss of $ 8,000. To avoid such large losses, you need to know a couple of things that we will talk about later.

Investing in Shares - Photo credit: freeimages.com

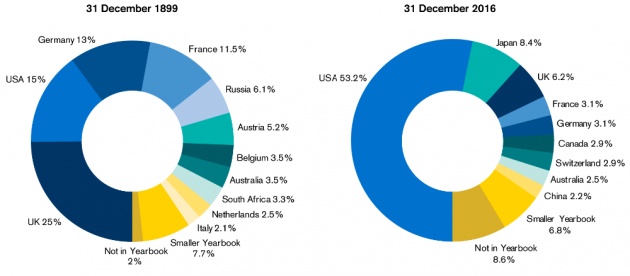

How is the World Divided by Stock Market?

Before examining the details of investing in shares profit sources, let's look at how the stocks of the world are distributed. What share of the global stock market is made up of US shares, Asian or other regional shares? We distinguish 4 main regions: North America, Western Europe, developed Asia, and the rest of the developing world.

- To North America belong the United States, and Canada only.

- To Western Europe belongs many countries: Great Britain, Germany, Switzerland, Italy, France, and similar countries in Europe.

- Developed Asia: Japan, Australia, New Zealand.

- The developing world is China, Russia, Brazil, Turkey, India, South Africa and all other emerging markets in the world.

Of these four regions, North American shares are more heavily weighted. Their weight is about half of all shares. The other side consists of the other three conditional ones, and their weight is almost equal in weight.

The USA is exceptional

If you decide to invest in a global stock basket and do not invest in US shares, you eliminate half of the world's stocks. The US is important not only because it shares a half of the global stock market. The US has the longest documented stock market history. We can know what changes in stock prices were for a hundred and more years, what the profit indicators were, how much dividends the companies paid.

If to analyze the long history of US stock market, we will see that the average annual return on investment (100 years) in US stocks was close to 10%. Specifically 9.5%. This is almost twice as much as it was possible to earn in the same period investing in US bonds.

Invest money in Shares - Photo credit: stepfatherlife.blogspot.com

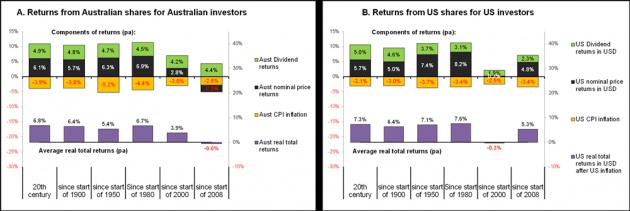

What Creates the Earnings from Stocks?

When we know that the last century's average annual return on stock investments was about 10%, it's worth asking what are the sources that create such a return? I already mentioned that there are two major profit sources of investment in shares: dividends paid and increased value of the company due to profit growth.

Splitting the history of the United States for decades and analyzing the profit of investing in shares, we find that was only one decade of negative profit generated by the companies after the Great Depression. In all other decades, companies have been profitable. Dividends have been paid by companies for all decades. Sometimes they accounted for more than 5%, sometimes less, but an average of 5% every year.

So, we have 2 essential ingredients of what is the return on investment in stocks. When deciding whether to invest in shares or not, you should first consider what dividends the company or companies in the region typically pay, and secondly, what is the average expected profit growth for the next decade (and, accordingly, the expected increase in the value of companies).

Profit of Investing in Shares - Photo credit: bigdohoda.blogspot.com

If there were only two sources of investing in stock profit, the amplitude of the stock fluctuations would be significantly lower. Every decade of the whole examined period these two sources gave a positive return to the holders of the shares, but the owners did not always earn real money.

There is still another - third source that decides how much stock owners earn. This ingredient is much more difficult to predict, affecting much larger stock price fluctuations. It can be called "speculative return." This part of the profit can add 10% annually to shareowners in one decade, and the next decade can deduct 10% annually. The speculative component is constantly fluctuating: after a very bad decade is coming the neutral or better decade.

We get the total return on investment in the aggregate all three components: increase in the value of company due to growing profit, dividends, and speculative returns.

Not a Steady Overall Return Rate

If we look at the historical results after already having accumulated all three components of the return: dividends, profit growth (value's growth) and speculative returns, we would see that the overall return rate is much more volatile than when we only assessed dividends and profit growth.

Out of the analyzed 8 decades (from 1930 to 2010), there were 2 decades when the total return on investment was negative. This was the case after the Great Depression and in 2000-2010. It is worth pointing out that if you can see that the result of investing in shares over the past 10 years is close to 0 or even negative (the total returns for all 3 components were close to zero or negative), it is really worth starting to think about the possibilities of investing in stocks.

Investing in Shares - Photo credit: cuffelinks.com.au

How Many Profitable Years we Can Expect?

We have analyzed the results of investing in shares by dividing the results history for decades. Now let's look at what the changes were in an interval of one year. In the last 70 or 80 years, as much as 70% of the stock years changes were positive. Meanwhile, another 30% annual results were negative. What does this mean? If you invest for a decade, you can expect that from ten years the three will be loss-making.

Compared to bonds, this is more. Investing in bonds, we can expect to receive one-year negative results during one decade. Investing in stocks, we can expect to receive three-year negative results in the one-decade interval.

Another important factor - even when the result is negative, most of the losses were from 0 to 10%. Such a lossy year, when the total US stock result would reach 10, - 20 or - 30%, is very rare. So, investing in stocks for ten years, we will probably have 7 profitable and 3 negative years. We need to be ready for three bad years.

In the general assessment of how much the stock fluctuates, it is found that the majority of annual changes will be roughly from -10 to + 40%. The fluctuation amplitude is higher than that of investing in bonds. However, when evaluating averages, we always have one problem - they are not of steady size.

Credit: Amber255

By analyzing 100 years of history, we can bring a certain average, but analyzing the whole story in more detail, we can see that the average is changing. There were periods when of 10 years only 6 were profitable, and there were periods of 10 years with 9 profitable years. Interesting fact - analyzing US stock history, we will not find a single period when it was profitable for 10 consecutive years.

There has always been at least one lossy year. Here again, I want to emphasize - when you face the situation, when in the last decade, there were not three, but 4 or even 5 lossy years, it usually means that now it is enough good time to invest. The shares will likely be cheap and appreciated the relatively attractive. You will get a fairly good value for the money you invest.

Profit of investing in shares - Photo credit: blog.masterofproject.com

The World Average Result - the Real 5 - 6 Percent

Let's analyze the history of the last 100 years in the larger world stock markets. How did other countries' stock markets work? There were countries with an average annual return lower than the USA. There were countries with an average annual return exceeded 10% and hit nearly 12%.

All results always are negatively corrected by the inflation. In the lesson about bonds, I mentioned that the global average inflation is about 3 - 4%. World stocks annual return average after adjusting the inflation rate is about 5-6%. This is a good enough indicator.

Of course, over the last 100 years, there have been such countries with the real return on investment exceeded the global average, but were also those with an average annual return on investment lower and reached just 2 - 3%.

But the essential thing that now I want to emphasize - no negative real return on investment to stocks has been recorded during the last 100 years in any of the countries under analysis.

Invest in Stocks - Photo credit: bookurprofit.blogspot.com

What if to analyze shorter periods?

Let's analyze the last 30-year story. How exactly the US stocks fluctuated and what the investor could expect, and how much he could earn in one or the other period? Even with a slightly shorter period, we can see,

that the average annual return is close to the long-term average - about 9%. But sometimes, for a short while, stock losses stood at 50% or even more. This was the 2008 crisis in full swing, this happened after the 2000 bubble explosion...

Although the long-term return of this period is close to the historical 9% returns, there are times when the return was much higher than the average and there are periods when the return was much lower than

average. What does this mean? Stocks are moving in a certain cycle. A lot of things influence it. Again, I remind the simple truth that after a bad period comes a good period, after good there is a bad period.

Cheap or Expensive Stocks?

How to determine if there is a good time for a long time invest in shares or not? My teacher suggested to use enough primitive method - just analyze what was the stock price change for the last five years, what was the change in the last decade, the last twenty years. Having received results, you should think the opposite.

If the latter five-year, ten-year period was very bad, it is much more likely that the other five and ten-year period will be better. If the long-term average is 9 or 10%, but in the last 10 years the return has been close to zero, it means that much higher probability is that in the next 10 years the average return will be close to 10% or even higher. This is the easiest way to assess whether it's worth now to invest money in shares or not.

The general rule is that any item is better to buy cheaper and most often this item (in our case shares) will be cheaper when the last decade was poor, the return was close to zero or negative.

THE 7 MISTAKES BEGINNERS MAKE! Stock Market For Beginners - Video credit:

Ryan Scribner via Youtube.com

Price Earning Indicator

Finally, I will present one more very popular and simple method to assess whether stocks are currently cheap. This method allows you to evaluate individual stocks, the entire region, the whole world shares in general.

This is called a cyclical profit indicator for one share, more commonly called the English term Price earning indicator, even more often just a P/E indicator. This indicator is calculated very simply - the share price is divided of the earnings per share. Getting certain number is the value of the P/E indicator.

Example: Let's imagine that the price of a share is $100, while the profit per share - $10. Then $100 is divided by $10, and we get the number 10. The indicator is equal to 10. What does this mean? Simply speaking, this means that if nothing changes, your investment will pay off within 10 years. Ten years of your investment annually generating a profit of $10.

Credit: Amber255

The logic is simple - it's assumed that the normal indicator is 15. If the value of the indicator is less than fifteen - 10 or 5, it is considered that the shares are cheap. If the indicator value is greater than 15 - 20, 25 or more, the shares are considered to be expensive.

On the Final Note

Thanks to modern technologies, shares are not just a type of wealthy people' investment. The stocks became very popular after the stock exchange became available to anyone interested in investing. Today, stocks can be traded having even few hundred euros. Shares are the most popular and one of the best ever invented investments. Every day, the newspapers write about daily stock exchanges, about them you can hear on television, and every day more information is provided on the Internet than it's possible to read.When investing in stocks, there are two major sources of profit: investment growth (due to growing corporate profits), and paid dividends.

Earn Money in Stock Market - Photo credit: Amber255 via Bitlanders.com

What should we remember about stock investment?

- On average, shares of global corporations over a long period of time can earn about 9 - 10% annual return, which consists of these two ingredients.

- The real return on stock investments minus inflation is about 5 - 6%.

- Stocks are particularly risky, means, there can be experienced 30-50% loss. It may be that the whole decade will be a loss, or there can be that 10 years' total return will be close to zero.

- Shares are recommended only for those investors, whose investment horizon is more than 10 years.

- For the conservative investors or those with an investment horizon of a year, two, or five years, this investment type is not recommended.

The stock market is a great way to hire your money - albeit with a great deal of risk, but with the best earnings from the investment types.

We live in an unstable world. That's why you have to take control of your future as soon as possible.

*************************************************************************************************

Thank you for stopping by and reading my blog.

2018, All Rights Reserved.

You are very welcome to join Bitlanders and share your valuable knowledge and opinion.

***************************************************************************************************

You can check my other blog about investing:

1. The Basics of Investing: First Lesson - What is Money Investing?

2. The Basics of Investing: Second Lesson - Profit and Risk

3. The Basics of Investing: Third Lesson - Bonds

3. Investing for Beginners: Easy Steps and Tips to Start Investing

Come back to find more...

**************************************************************************************************