Forex Market Structure and function.

Let us first examine a market that you are probably very familiar with: the Forex Market stock market. This is how the structure of the stock market looks like:

“I have no choice but to go through a centralized exchange!”

By its very nature, the stock market tends to be very monopolistic. There is only one entity, one specialist that controls prices. All trades must go through this specialist. Because of this, prices can easily be altered to benefit the specialist, and not traders.

How does this happen?

In the stock market, the specialist is forced to fulfill the order of its clients. Now, let’s say the number of sellers suddenly exceed the number of buyers. The Succeful, which is forced to fulfill the order of its clients, the sellers or buyer in this case, is left with a bunch of stock that he cannot sell-off to the buyer side.

In order to prevent this from happening, the specialist will simply widen the spread or increase the transaction cost to prevent sellers from entering the market. In other words, the specialists can manipulate the quotes it is offering to accommodate its needs.

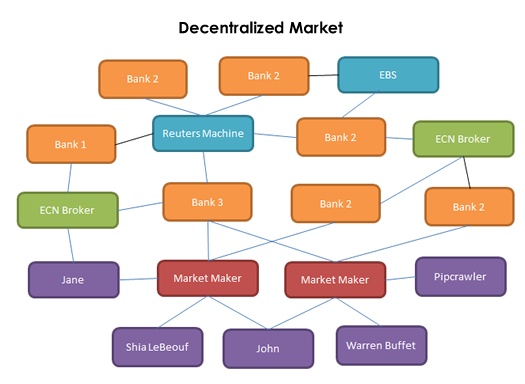

Trading Spot FX is Decentralized

Unlike in trading stocks or futures, you don’t need to go through a centralized exchange like the New York Stock Exchange with just one price. In the forex market, there is no single price that for a given currency at any time, which means quotes from different currency dealers vary.