Long before I became a licensed Financial Adviser, I had been practicing what we call financial stewardship. I was a member of Catholic charismatic community. From the group, I learned how to tithe. My practice then was, every time I receive my salary I will put a certain percentage of it in an envelope and give it to the community during our monthly gathering.

Suffice to say, I was blessed because of this practice. My salary was not that big. Perhaps, just a little above the minimum wage at the time. I was working in Cebu City, which was far from my home. Back then I was renting a room and commute to and from my work. Every time I eat, I have to eat at a restaurant or a karinderya (a small restaurant with affordable food). I go out with friends, watch movies, go places, etc… Whenever I have extra money, I would send it home.

There was more than one occasion that I ran out of money a few days before the next payday. These are the moments that I would feel really blessed. Why? Something would always come up that would help me with needs. I get free meals and ride, or I get a sideline job, or someone who owes me money would suddenly pay me. At the perfect timing too!

I was financially blessed and provided for because of my tithings.

Image Credit: @Artbytes created using The Bible App

However, when I quit my job and went back home, that's when I felt that something was missing. I was asked to take over our family business. Which was financially in trouble.

The business is similar to my work in Cebu. Sure enough, I was able to take care of the technical problems. Plus I offered new services to augment the income. However, I had no managerial skills and my financial literacy at that time was close to nothing!

Even my personal finance suffered. I lost all the little savings that I had. That's when I had that something is missing. What I know about financial stewardship was not enough! Tithing was not enough! It was just the beginning.

I realized that somehow, I had to increase my knowledge in financial stewardship or financial management, or in short, I had to increase my financial literacy!

Good thing I am an avid book reader. So I borrowed and bought some books that talks about personal finance. The books that I listed here are just 6 of the of that books that helped improve my financial literacy.

But before I share with you the 6 books that will improve your financial literacy, let me share with you the What and Why first.

What is Financial Literacy?

Financial literacy is the education and understanding of various financial areas. This topic focuses on the ability to manage personal finance matters in an efficient manner, and it includes the knowledge of making appropriate decisions about personal finance such as investing, insurance, real estate, paying for college, budgeting, retirement and tax planning.

As defined, financial literacy is the education or knowledge that focuses on the ability to manage personal finance. This includes budgeting, investing, retirement and even tax planning.

Perhaps, most of us know how to make a monthly budget. However, budgeting is just one factor of financial management. Once you improve your financial literacy, you will be able to maximize your income and make your money grow!

From "Rich Dad Poor Dad"

Image Credit: @artbytes

Why Do You Need to Learn or Improve Your Financial Literacy?

You might be thinking:

"Ah, this is a thing for accountants and bankers!"

That could never be farther from the truth. Forbes.com says:

"If your financial knowledge is only to save money in a bank, then you need to improve your financial literacy."

Financial Literacy is not just for the rich. It is also for the regular 9 to 5 employee. The security guards, the drivers and even the housemaids and helpers. Financial Literacy is FOR YOU (and me)!

Video Credit: Institute for Financial Literacy 101 Via YouTube

How to Improve Your Financial Literacy?

There are a number of ways to improve your financial literacy actually. According to Forbes ( Five Simple Ways to Improve Your Financial Literacy), the first way is to read as much as you can!

Fortunately, these days information about financial literacy can be read from the Internet, ebooks, magazines, and books. My favorite medium for reading is BOOKS.

So in this post, I will share with you the 6 Books That Will Improve Your Financial Literacy.

1. Rich Dad Poor Dad

by Robert Kiyosaki

Image credit: http://www.knowledgeisking.co.uk/

The very first book that I read about personal finance and an eye-opener. The author challenged the existing ways and beliefs of millions of people when it comes to handling money. Some of the key points that I learned from the book

- The difference between Assets and Liability. We were taught that a house is an asset. Robert Kiyosaki explains that it not always the case.

- The reasons why the poor struggle for money while the rich gets richer.

- The Definition and contrast of Good Debt and Bad Debt.

- The Cash flow of the poor, middle class and the rich and the Cashflow Quadrant.

- The idea of passive income and investments.

- The concept of earning from real-estate investments (Not just buy and sell).

"The main reason people struggle financially is that they have spent years in school but learned nothing about money. The result is that people learn to work for money… but never learn to have money work for them."

-Robert Kiyosaki

These are just some of the key points that I learned from the book.

2. Simplify and Create Abundance

by Bo Sanchez

Image Credit: http://www.kabayancentral.com/

Bo Sanchez is a dynamic Catholic preacher and the best selling author. Simplify and Create Abundance is the first of the books and ebooks he authored that I read. I bought my first copy of this book when he came to my hometown to preach.

In the book, the author likened our financial struggles to the plight of the Israelites in the time of Moses. Where at the time:

- the Israelites were slaves of the Egyptians.

- Though they are slaves, they are afraid to flee Egypt because they don't know what will happen to them if they do.

- Though they are mistreated, they are "comfortable" being slaves because they have their lives and have food to eat.

- When the Pharaoh finally set them free, the wandered through the desert for forty years.

- Before they reached the promised land, they suffered and endured thirst and hunger.

- During those times of hunger and thirst, God provided them with "manna", meat and water from the desert, until they reached and occupied the promised land. The land flowing with "milk and honey".

Some of the lessons that I learned from the book are:

- Like the slaves of Egypt, we don't want to leave, no matter how bad our financial situation is, because of fear.

- In our journey to financial freedom, we could go through the desert, Where we experience difficulties.

- However, in times of difficulties, we will have enough "manna".

- Once we reached the promised land, we will have more than enough!

The book has so many important lessons to learn actually. But once you internalize the lessons, it could keep you going through your journey to your financial freedom.

3. The Abundance Formula

By Bo Sanchez.

I got this book as a bonus from a subscription. In this book, Bo Sanchez explains one of the secrets to achieving financial freedom. Namely, Save first! The author emphasized the error and consequence of our usual habit which is to spend first before we save, and emphasized that once we got our income, our formula should be:

"Income - save-tithe=expenses"

Meaning, once we got our income, we deduct our savings and put it in a bank, deduct the tithe and the remaining is our budget for our expenses. And how much should we set aside?

100%-20%-10%=70%

This means we have to learn how to live within 70% or less of our monthly income.

(Please see the links below for my series of post regarding this.)

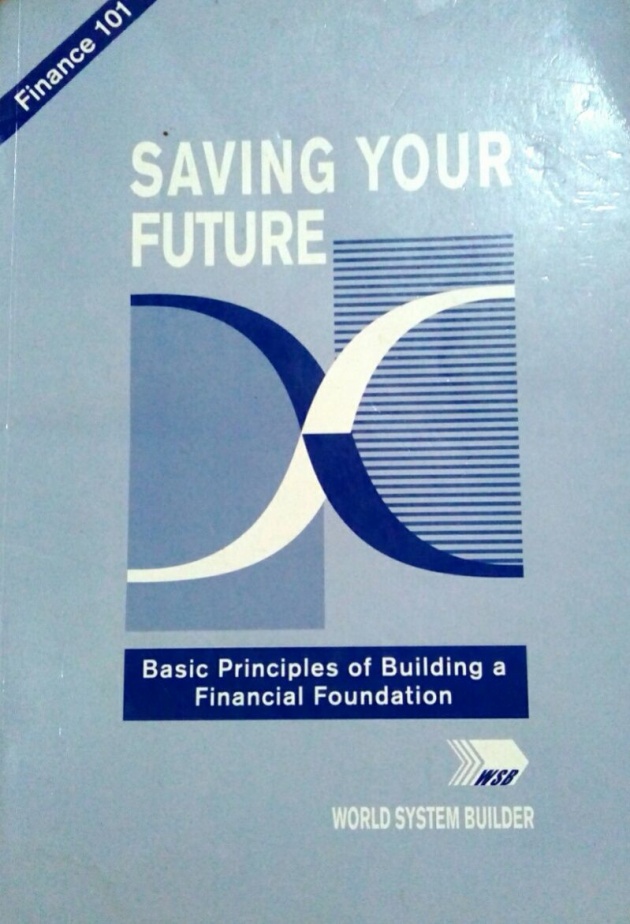

4. Saving Your Future

by World System Builder

Image Credit: @Artbytes

In this book, the author explains the basics principles of building a solid financial foundation. Also, the author explained the relationship of our present responsibilities and why we should save for our future.

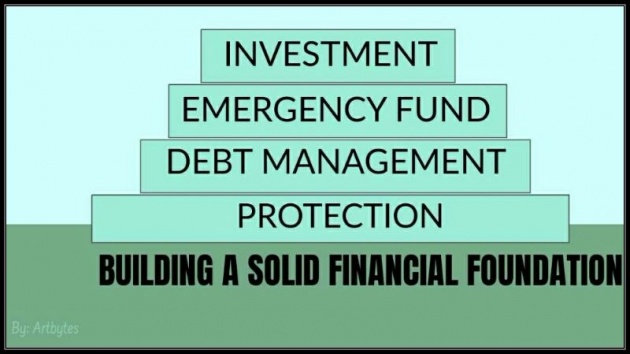

Image credit: @Artbytes via Bitlanders

Like a pyramid, we should the first build the most important factor as the base, which is

- PROTECTION (insurance).

- Then followed by DEBT MANAGEMENT,

- then EMERGENCY FUND

- and lastly INVESTMENT.

Following this order of building our financial foundation, we are taking care of the present first, while saving (and investing) for our future. Once we have built a strong financial foundation, we can achieve financial freedom.

5. 8 Secrets of the Truly Rich

by Bo Sanchez

Image Credit: Kerygmabooks.com

Another book from my favorite preacher and author. It this book he outlined well… the secrets of the Truly Rich.

Here is one intriguing lesson that I learned from the book. Whatever our financial situation right now, we are responsible for it. Just as we are responsible if we become rich or not. It was our choice if we are rich or poor or somewhere in the middle right now. The rich became rich because of their decisions and took actions on those decisions. The poor remained to be poor because of their decisions, including decisions NOT to take actions.

Where I am now, is because of my decisions in the past. Where I will be, will be the results of the decisions I am making now.

"I have now given a choice between a blessing and a curse. When all these things have happened to you… you will remember the choice I gave you."

-Deuteronomy 30:1

Life is a choice. Let's choose wisely.

6. Simplify and Live A Good Life

by Bo Sanchez.

Image Credit: Kerygmabooks.com

This book actually came out before the Simplify and Create Abundance. The teachings of this book, however, compliments what is discussed on 8 Secrets of the Truly Rich and the Simplify and Create Abundance.

The focus of the book is to find a way to simplify our lifestyle. To find happiness without spending.

Some of the lessons that I have learned from this book:

- By simplifying our lifestyle, we would realize that often times we spend more that need to, We don't have money because we spend so much on our wants.

- Because of this book, and its sequel, Simplify and Create Abundance, I was able to some money every month.

- By living a simple life, we will soon realize that we were more blessed than we often see.

Simply put, we can live a good life even if we don't spend so much.

These are just 6 of the books about personal finance that I read. There are still some other books that I have read but can't recall their exact titles.

Challenge to your views about money

There are at least two things in common about these books.

- They teaches principles on how to improve your financial literacy.

- These books challenges the old ways of looking at money. These books, will challenge how you view money.

Invest in Literacy

As stated by Forbes, the first step in improving your financial literacy is to read a lot. These books are just a fraction of the numerous resources available. There are numerous good books about Financial Literacy available in printed, digital (e-books) or even audio (audio-books) form.

Plus there are a lot of Youtube Videos that teaches how to improve your. financial literacy.

Before you invest your money in anything, it is best that you invest in literacy first. Invest in you financial literacy.

Financial Literacy 101

Video Credits: Success Resources Via YouTube

This is it for now. This is John (a.k.a Artbytes) saying, let's all have an abundant 2018! Or borrowing my favorite Vulcan's customary greeting:

"Live Long and Prosper!"

~oO0Oo~

John Reynold Loberiza (a.k.a @artbytes) is a freelance graphic artist, web developer, and blogger. He is also a licensed Financial Adviser under Insular Life- the only Filipino owned Insurance company. The content of this blog post is based on the author's studies and personal experience on the subject.

If you have any reactions or inquiries regarding the subject of this post, please write it in the comment or send the author a private message.

Join Bitlanders

If are not a member of Bitlanders yet and you are a content creator- a writer, blogger, photographer, an artist or a hobbyist, you can earn from your creations (blogposts, photos, artworks, or videos) by uploading them in Bitlanders.

Join now by clicking here.