1. Strong U.S. Jobs Spell Gloom for Emerging Markets

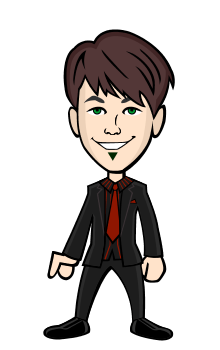

Strong U.S. employment data paved the way for the Federal Reserve to raise interest rates next month and sent the dollar to its highest level in almost 13 years. Investors positioning for higher rates sent Treasury bonds and utility stocks down and bank stocks up. One area likely to take a big hit: Emerging markets, where a stronger U.S. dollar likely shuts the door on a weekslong rallythat lifted currencies from the Mexican peso to the Russian ruble. A stronger dollar typically means lower prices for commodities, hurting nations that depend on resources for growth.

2. More Blows for Valeant

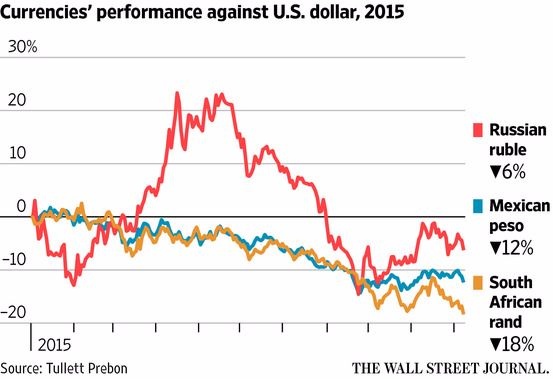

The roller-coaster ride continued for investors in Valeant Pharmaceuticals, not least activist William Ackman, who has made a big bet on the company. Shares of the embattled drug company hit new multiyear lows this week as aWall Street Journal article on Mr. Ackman sparked questions about the future of Valeant CEO Michael Pearson (although Mr. Ackman then reiterated his support for the executive) and as Mr. Pearson was forced to sell a big chunk of his company stock after a lender called in a loan backed by the shares.

3. China Enters a Bull Market

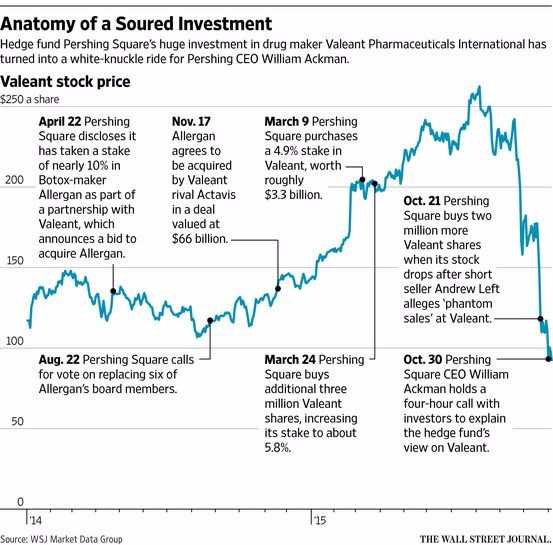

So much for that summer swoon. China entered a bull market this week, a surprising milestone after a volatile summer wiped out trillions of dollars in value from mainland equities and rattled global markets. As of Thursday, the Shanghai Composite Index had gained 20% since hitting bottom on Aug. 26. Chinese officials dug deep into their playbook for ways to stabilize domestic markets, including pumping money into state-backed funds that bought stocks, cracking down on short sellers and suspending initial public offerings. In a vote of confidence that that the measures are working (perhaps too well), Beijing said Friday it would shortly resume IPOs.

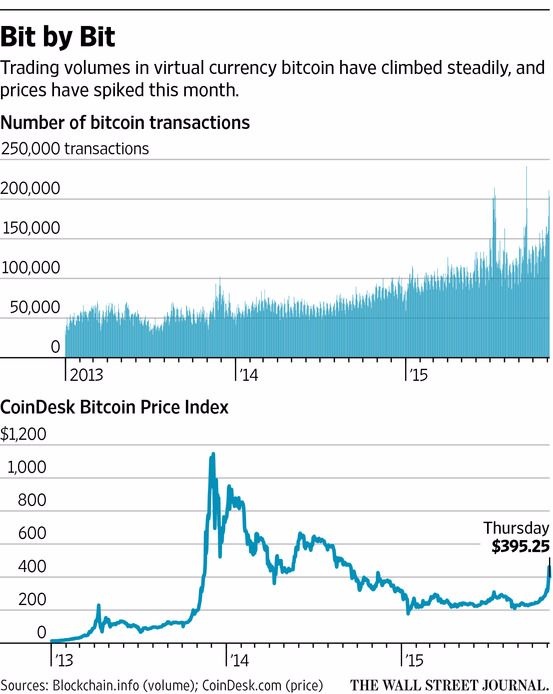

4. Bitcoin Is Back

Talk about bouncing back. The price of bitcoin climbed as much as 50% this week, re-creating scenes from a manic 2013 run that took the digital currency from $13 to $1,100 before it crashed. The burst of speculative buying followed a spate of positive publicity and a move by the European Union to define bitcoin as a currency and not a commodity. More quietly, there is an uptick in consideration of how bitcoin’s underlying technology—a sort of decentralized register of transactions—could be applied to traditional finance.

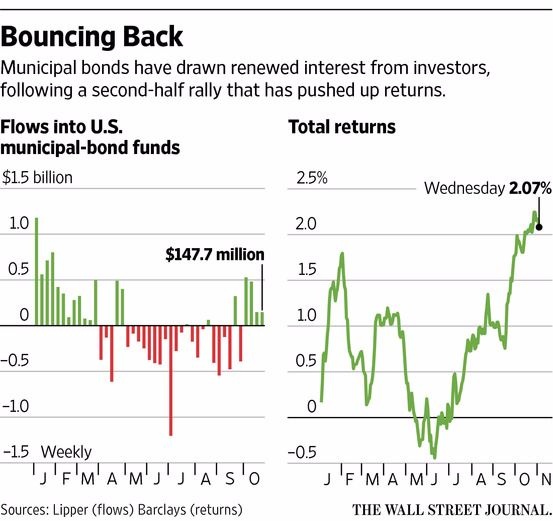

5. Hot Invesment: Munis

Check out this hot investment: Municipal bonds sold by U.S. state and local governments are returning about 2% this year, beating corporate bonds and many other supposedly higher-performing asset classes. It is the second year of near market-leading returns from a sector typically prized for its low, steady performance, and comes as the concerns facing muni bonds–including, in some cases, default–seem manageable to many investors, compared with the risk of a steep pullback in stocks or other riskier assets.