Thanks to startups like Simple, which was acquired by financial services organization BBVA last year, banking customers got a look at what a modern-day web and mobile banking experience looks like, with features like goal-setting tools, automated categorization of expenditures, real-time notifications of new charges pushed to your mobile phone, the ability to block a lost or stolen card right from the mobile app, and more. Now, a new startup called Bankjoy wants to bring a similar experience to other, smaller banks with a white-labelled product and accompanying API platform that’s initially being aimed at credit unions.

The Y Combinator-backed startup was founded by Michael Duncan, who worked for years at a credit union himself, first as a programmer, then later promoted to manage the company’s online and mobile banking services.

While there, he realized that the architecture and developer tools the bank used could be improved, as well as the vendor relationships. For example, he tells us, the credit union didn’t know when its mobile banking service went down until one of its customers called in to report trouble.

“I always believed the vendor should know, and should be letting us know something’s wrong, even before members do,” says Duncan. “Also, I wasn’t satisfied by the rate of innovation by the vendors,” he adds.

He speculates that the vendors weren’t motivated to innovated more quickly because of the contract lengths that are standard in the industry – they would typically sign agreements of two to five years with their banking partners. “A big vendor would get lots of these contracts signed, then they wouldn’t update their user interface, or they wouldn’t modernize their experience, or they wouldn’t add new features,” Duncan explains.

That motivated him to begin building out a product that would offer a better mobile banking service to banks like the credit union he used to work for, and in the future, other, smaller community banks, too.

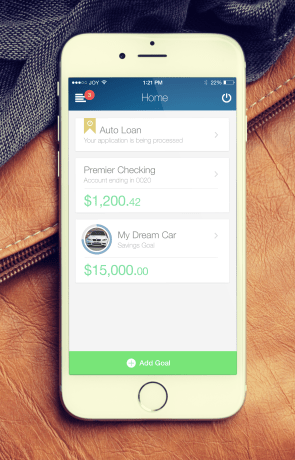

The idea is to deliver a service where there’s a greater emphasis on the user interface and the design, as well as other modern upgrades like the ability to log in using a PIN on your smartphone, make remote deposits using your phone’s camera, manage your debit card and block it when lost or stolen right from the app, set financial savings goals, make person-to-person payments, pay bills from your phone, and more.

Plus, as consumers set their personal savings goals in the app, the credit unions could use this data to offer them targeted loans and mortgages – similar to something like Mint.com, for instance.

Basically, Bankjoy is providing a lot of the same sorts of features that bigger banks offer, with a user experience that’s inspired by innovative startups like Simple.

Basically, Bankjoy is providing a lot of the same sorts of features that bigger banks offer, with a user experience that’s inspired by innovative startups like Simple.

Today, there are over 6,000 credit unions in the U.S., serving nearly 100,000,000 members, but they don’t have the in-house resources to build and maintain their own mobile banking apps, the company notes. Bankjoy would instead offer them the ability to brand its application and make it their own, using their own logo and color scheme. Additionally, they could host it themselves in-house, or Bankjoy could host it on its secure cloud platform, where it offers 24/7 monitoring and support.

And once the app is deployed, the credit union could also take advantage of the Bankjoy REST API so developers could build other applications, like budgeting tools or online banking.

Though only a few months old, Bankjoy says it has 100 credit unions who have indicated they would be willing to demo the software, which the company plans to charge for at a rate of $1 per active user per month. Duncan says that each roll out, which takes 30 to 60 days, will include working to integrate Bankjoy with that credit union’s existing software from other vendors. The goal is to ultimately be able to accommodate any vendor, he notes.

“We intend to make [our API] standard across the industry, so every bank and every credit union in the world will have a standard interface that developers can code to,” says Duncan.

Bankjoy is also working to expand its mobile banking experience to online banking, and it’s even working on an Apple Watch app, too.

The company still has a way to go, however, to meet its many goals – it’s only now participating in Y Combinator’s program, and its staff, while including some talent from the banking industry, is still largely part-time.

That said, there’s definitely a need for better products in this typically slow-moving industry – the question now is whether or not Bankjoy’s approach of marketing to the credit unions directly will work out.