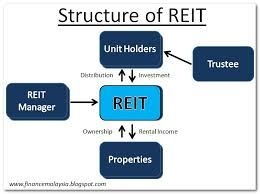

SECURITIES AND EXCHANGE BOARD OF INDIA issued new listing rules of Real Estate Investment Trust (REIT) in Sep, 2014. Real estate companies has found a new and easy way to raise funds from the market because of this rule. REIT has been exempted to bring a minimum of Rs 250 crore. These trusts has to sale at least 25 per cent of their total stake through public issue. With a capital base of over Rs 500 crore trusts will be allowed to enter the stock market. 80 per cent of capital raised through these bodies must be spent to build buildings or in rental activities. These funds will not be able to be used for any kind of invest in arable land or completely vacant land. SECURITIES AND EXCHANGE BOARD OF INDIA rules also says that at least two lacs of rupees will have to be invested in these issues. Small investors will not be able to afford them. SECURITIES AND EXCHANGE BOARD OF INDIA has taken such a step after looking at the high level of risk, so small investors to stay away from it.