PERFECT COMPETITION

Imagine yourself as a street food vendor, selling tacos topped with fried onions, ground meat, cheese and spicy sauce in the main plaza of a town. There are three other taco vendors on other corners of the plaza selling the exact same thing of the same quality. None of the other vendors (nor you) can change the price, because everyone knows that the deal is 3 tacos for Rs 100. Anyone else who wants to sell tacos on the street can do so, and if you want to quit and sell something else one day (or sell your tacos at one of the many other public spaces in your town), no one is stopping you. A business expert might describe this as perfect competition (or a perfect market or pure competition), which means an equal level for all firms involved in the industry. But what does that really mean?

Perfect competition is a theoretical extreme. The main point of studying this model is that it acts a benchmark for real-world competition. The performance of actual firms can be judged against this most efficient model.

In order to attain perfect competition, several factors need to be met. The following list outlines some of the main factors:

· A large number of buyers and sellers who have perfect knowledge of the market conditions and the price, which means that risk-taking is minimal and the role of the entrepreneur is limited.

· Firms are described as being price takers. No individual firm has any influence on the market price. The ruling price is determined by the forces of market demand and the output of all the firms. Therefore, a firm’s demand curve is perfectly elastic.

· The products are homogeneous. This means that they are all of the same quality and are identical in the eyes of the consumer.

· There is complete freedom of entry into and exit from the market.

· Each firm will seek to maximize its profits.

PROFIT MAXIMIZATION POINT

In a perfectly competitive market, the profit maximization is based on two approaches:

1. TR and TC approach

2. MR and MC approach

TR and TC Approach:

TR– TC = (P x Q) - (FC + VC) = economic profits

Output would be produced at the level where the economic profit is maximized.

MR and MC Approach:

Firms will produce until the point where marginal cost equals marginal revenue. This strategy is based on the fact that the total profit reaches its maximum point where marginal revenue equals marginal profit.

If,

i. MR>MC, the production will continue.

ii. MR<MC, the production will stop or fall back at the previous point of output.

PROFIT CATEGORIES IN PERFECT COMPETITION

(Short Run)

1. Abnormal Profit:

Under perfect competition, firms can make super-normal profits.

The firm’s total revenue is the price multiplied by the output sold. If the total cost of producing this output is lower than the total revenue generated, then the firm will be making an abnormal profit.

When TR>TC, the profit is greater than 0.

2. Normal Profit:

It is also known as the break-even point. At this point, the TR=TC, i.e. the profit is equal to 0.

3. Economic Loss:

It is also referred to as minimum negative profit. At this point, the TR>TVC. This leads to a profit value to be negative.

4. Shut Down:

The shutdown point is the point at which the firm will gain more by shutting down than it will by staying in business.

As soon as the firm becomes unable to cover its AVC, i.e. the cost of paying the wage bill and buying the materials for production, the shut-down point will arise.

At this point, the TR<AVC, which again leads to a profit value to be negative.

PROFIT CATEGORIES IN PERFECT COMPETITION

(Long Run)

In the long run, the firm is only able to make normal profits. This is because the super-normal profit derived by the firm in the short run acts as an incentive for new firms to enter the market, which increases industry supply and market price falls for all firms until only normal profit is made.

BENEFITS OF PERFECT COMPETITION

Now that the factors have been introduced, you might be asking, what are the benefits to a perfect market? Let's look at some of the benefits in more detail:

All of the knowledge, such as price and information pertaining to the goods, is equally dispersed among all buyers and sellers. In other words, there are no secrets, and communication about the products is shared evenly, preventing corruption.

Since there are no barriers to enter the market, this makes it impossible for a monopoly to occur.

Advertisement is not needed in a perfect competition because all goods are the same and customers have all the knowledge pertaining to those goods.

Only normal profits are made in the long run, so producers just cover their opportunity cost.

There is a vast choice for consumers.

There is maximum allocative and productive efficiency:

i. Equilibrium will occur where P = MC, hence allocative efficiency.

ii. In the long run equilibrium will occur at output where MC = ATC, which is productive efficiency.

EXAMPLES OF PERFECT COMPETITION:

In the real world it is hard to find examples of industries which fit all the criteria of ‘perfect knowledge’ and ‘perfect information’. However, some industries are close.

Foreign exchange markets: Here currency is all homogeneous. Also traders will have access to many different buyers and sellers. There will be good information about relative prices. When buying currency it is easy to compare prices.

Agricultural markets: In some cases, there are several farmers selling identical products to the market, and many buyers. At the market, it is easy to compare prices. Moreover, there are no barriers to entry into or exit from the market. Therefore, agricultural markets often get close to perfect competition.

Internet related industries: The internet has made many markets closer to perfect competition because the internet has made it very easy to compare prices, quickly and efficiently (perfect information). Also, the internet has made barriers to entry lower. For example, selling a popular good on internet through a service like e-bay is close to perfect competition. It is easy to compare the prices of books and buy from the cheapest. The internet has enabled the price of many books to fall in price, so that firms selling books on internet are only making normal profits.

DETERMINING PROFIT AND LOSS FROM A TABLE OF COSTS

• Profit can be calculated from a table of costs and revenues.

• Profit is determined by total revenue minus total cost.

• The profit-maximizing position is not necessarily a position that minimizes either average variable cost or average total cost. It is only the position that maximizes total profit.

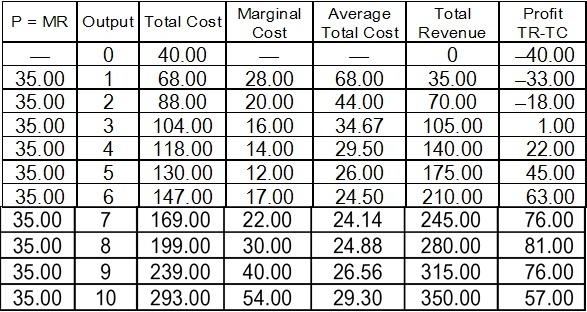

Costs Relevant to a Firm

In the above table, the optimum level of quantity is 8. This is because at this point, the profit is at its maximum point.

How realistic is the model?

Very few markets or industries in the real world are perfectly competitive. For example, how homogeneous is the output of real firms, given that even the smallest of firms working in manufacturing or services try to differentiate their product.

Although unrealistic, it is still a useful model in two respects. Firstly, many primary and commodity markets, such as coffee and tea, exhibit many of the characteristics of perfect competition, such as the number of individual producers that exist, and their inability to influence market price. Secondly, for other markets in manufacturing and services, the model is a useful yardstick by which economists and regulators can evaluate levels of competition that exist in real markets.