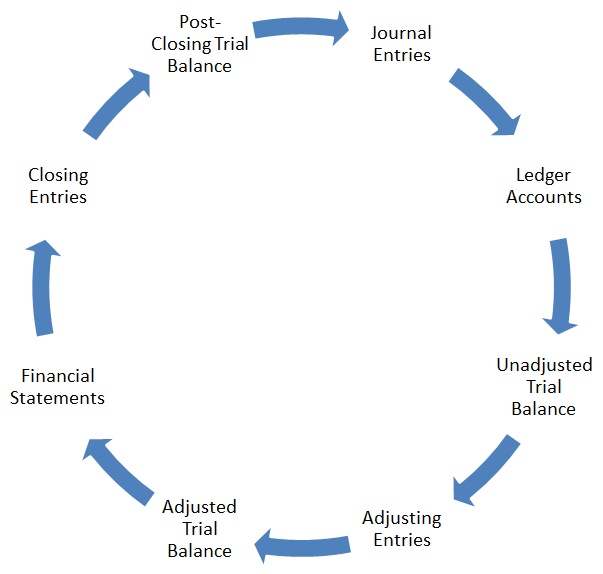

THE ACCOUNTING CYCLE

Accounting cycle is a step-by-step process of recording, classification and summarization of economic transactions of a business. It generates useful financial information in the form of financial statements including income statement, balance sheet, cash flow statement and statement of changes in equity.

Major Steps in Accounting Cycle:

Following are the major steps involved in the accounting cycle:

- Analyzing and recording transactions via journal entries

- Posting journal entries to ledger accounts

- Preparing unadjusted trial balance

- Preparing adjusting entries at the end of the period

- Preparing adjusted trial balance

- Preparing financial statements

- Closing temporary accounts via closing entries

- Preparing post-closing trial balance

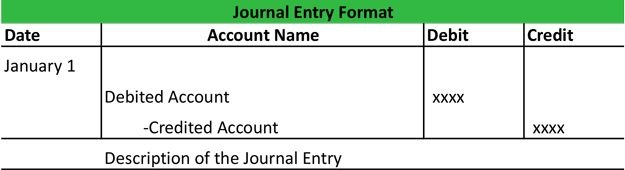

1. Analyzing and recording transactions via journal entries:

There are generally three steps to making a journal entry. First, the business transaction has to be identified. Obviously, if you don't know a transaction occurred, you can't record one. After an event is identified to have an economic impact on the accounting equation, the business event must be analyzed to see how the transaction changed the accounting equation. After the business event is identified and analyzed, it can be recorded. Journal entries use debits and credits to record the changes of the accounting equation in the general journal.

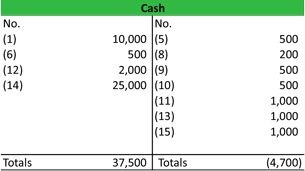

2. Posting journal entries to ledger accounts:

The next step in the accounting cycle is to transfer information from the journal to the ledger. A ledger is a book or an electronic record of all the accounts that a company has. These accounts are broken down by account number and class. When the information from the journal is transferred to the ledger, it is transferred to each account that was affected by a transaction.

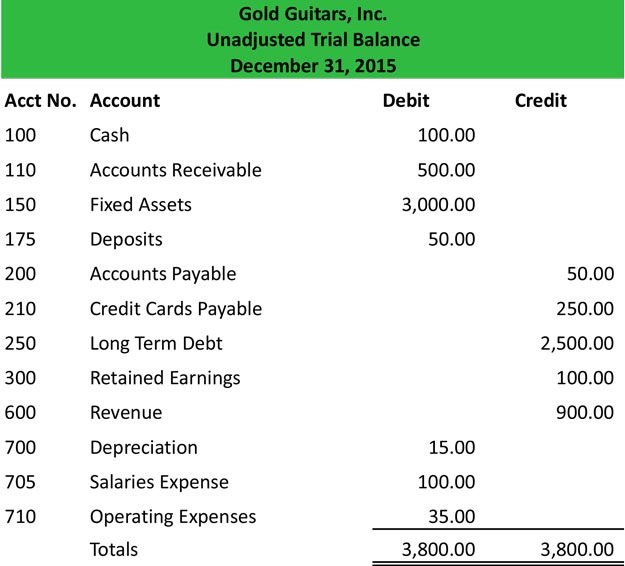

3. Preparing unadjusted trial balance:

After the all the journal entries are posted to the ledger accounts, the unadjusted trial balance can be prepared. A trial balance is a list of all the company's accounts and their balance at the time the trial balance is prepared. An unadjusted trial balance is a trial balance that is prepared before adjusting entries are made into accounts. This information comes directly from the ledger. The total debit balance and total credit balance must be equal.

4. Preparing adjusting entries at the end of the period:

Adjusting entries are entries that are made in the journal and posted in the ledger. The purpose of these entries is to bring account balances to the proper amounts. Not all accounts will have an adjusting entry. Adjusting entries are made at the end of the accounting period but not the end of the accounting cycle.

5. Preparing adjusted trial balance:

Remember, the trial balance is a list of all accounts and their balances after adjustments have been made. This trial balance is prepared to check and make sure that debits and credits equal after adjusting entries are made. It is used to prepare the financial statements.

6. Preparing financial statements:

You prepare the balance sheet and income statement using the corrected account balances. Preparing general-purpose financial statements; including the balance sheet, income statement, statement of retained earnings, and statement of cash flows; is the most important step in the accounting cycle because it represents the purpose of financial accounting. Financial statements are prepared by transferring the account balances on the adjusted trial balance to a set of financial statement templates.

7. Closing temporary accounts via closing entries:

Closing entries, also called closing journal entries, are entries made at the end of an accounting period to zero out all temporary accounts and transfer their balances to permanent accounts. In other words, the temporary accounts are closed or reset at the end of the year. This is commonly referred to as closing the books.

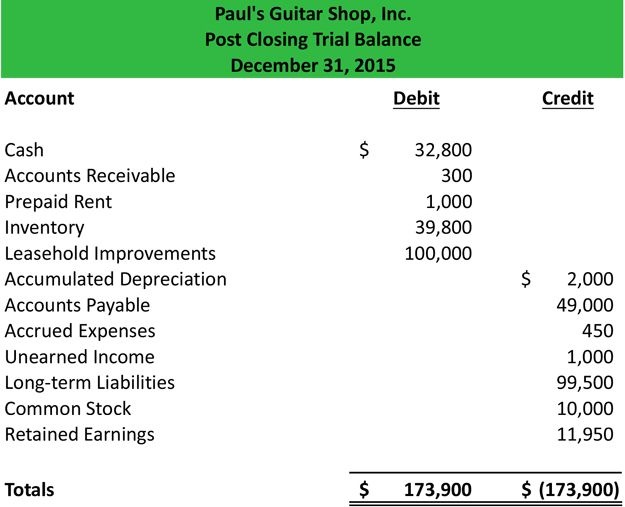

8. Preparing post-closing trial balance:

The post-closing trial balance is a list of all accounts and their balances after the closing entries have been journalized and posted to the ledger. In other words, the post-closing trial balance is a list of accounts or permanent accounts that still have balances after the closing entries have been made.