The Basics of Investing: Sixth Lesson - Alternative Investment: Real Estate

Photo credit: Amber255 via Bitlanders.com

Greetings to all my readers, old and new readers. I continue my series about the basics of investing, and this time we will talk about alternative investment. What means alternative investment? It means an investment in real estate, gold, petroleum, and other raw materials. Today, our theme is an investment in real estate. Let's talk about this type of investment, its risks, profitability, advantages, and disadvantages.

Are you interested in a real estate investing? Do you dream of becoming a real estate magnate? Maybe you want to build your real estate empire? Why? Is it due to the fact that real estate prices only increase? Unfortunately, the fact is that real estate prices do not rise to heaven. The economy is not only rising up but also has periods of decline. If you have bought a real estate when the economy is rising up, you can experience significant losses when the economy will start decreasing. We will learn about everything in this lesson.

Today, we will also examine what returns can we expected from a real estate investing, what are the sources of income choosing such an investment type? How much does this investment fluctuate? How to invest in real estate? Who can benefit from it? Why is it called a safe investment? Is it really safe?

Robert Kiyosaki Real Estate Investing - Video credit: ModelingTheMasters via Youtube.com

Is it the Real Estate Investment Risky?

Real estate is defined as the land or part of the land and all objects associated with it (buildings). Real estate is often identified with private property. It can be acquired in two ways - by buying or renting. If you are renting a property, then the ownership of it is temporarily passed to you. Investment in real estate is the acquisition of property, property management, real estate rental or sale with a purpose of earning a profit. As you can see, the purchase of own housing is not considered as an investment in real estate, since it is used for personal needs, not for gaining profit.

Before starting to go deeper, let's we briefly recall the map of the profitability and risk that has been reviewed several times in my blogs about investments. Real estate investments are in a very similar location on the map, just like an investment in stocks. Investments in raw materials or gold at the level of risk are far away from other investment types. They are sufficiently risky, but their long-term return should be close to inflation.

Real Estate Investing - Photo credit: blog.greenconcepthousing.com

The largest weight in the world's financial assets consists of stocks and bonds, while the share of the real estate is much smaller. After compounding real estate and gold, we get just 10% of total financial assets. So, we can say that these investment types are indeed alternative, their weights are much smaller and it is not surprising that traditional investment funds partially shy away from investing in these instruments. There are a much lower trade turnover liquidity and affordability, it can be said that these areas are more complicated and more expensive.

Investment in Real Estate - Photo credit: blog.riverlogic.com

Profit Sources of Investments in Real Estate

What are the main profit sources of investments in real estate? Many of our people have invested in real estate assets before the crisis, thinking how to sell it more expensive and earn from the increased value of the real estate. But by actually real estate investment property, we should first of all pay attention to what kind of an investment's return we can get of real estate rental. Renting it for a one, five years or any other period.

Two sources of profit:

Talking about the real estate investing, there can be distinguished two main sources of profit.

- The basic and fundamental point to which should pay attention those investors, who want to invest in real estate, is a rental yield.

- The second source of profit is the increase in value. In the long run, it broadly corresponds to the rate of inflation growth.

Real Estate Rental - Photo credit: jeevanpunnibroker.blogspot.com

Most people usually think that real estate investing field they will feel safer, or that this investment is much safer than shares are. The reality is that the value of real estate can fluctuate a lot, in practically the same as shares. Investing in real estate, we often invest in economic growth. We choose the region, we hope that it will attract more people, the number of people will increase, and this will increase the value of a particular real estate.

The 5 Golden Rules of Real Estate Investing - GrahamStephan via Youtube.com

How Much Does Investment in Real Estate Earn?

Before talking about positive and negative aspects of the real estate investing, let's first consider the long-term return on real estate prices over the last 10 to 20 years. If there is a long history - look over the last century. Why do we need it? Because most investors, who choose this asset class are primarily looking forward to an asset value increase.

I looked at the diagrams of my country, and I found that since 2002 up to around 2008, the prices of the apartments were rising at very high rates. Exactly then there was the impression that real estate investing is a very profitable activity. However, analyzing a longer period, for example, a period of 20, we will see that over the long term the value of real estate essentially reflects the pace of inflation. If you invest in buying an apartment, commercial or storage space, for a long time you would expect its value to increase with the size of inflation. Of course, if you bought the property in a good place, its value can be more expensive.

Credit: Amber255

Real estate is as risky as the shares are. In 2008, when the crisis started, the value of real estate dropped by about 50%. This is a similar amount of loss, that can be expected when investing in stocks.

Alternative Investment Real Estate - Photo credit: blog.sina.com.cn

Let's look at foreign experience, the price changes of Western Europe, USA, Australia for the past 100 years. I reviewed the history from 1900 to 2010. During the first 50 years, the real estate prices did not change, their growth was identical to the inflation rate. The next 50 years the increase was higher than inflation. If to take all 100 years term, we see that the average annual growth of real estate reaches a little more than 1%.

This confirms the view, that when investing in real estate for a long time, its price increase should be equal to the inflation. It can be 1-2 percent higher than inflation but to expect 10-20% the annual growth would be illogical and would equal to speculation.

While reading my new blog about alternative investment - real estate, please check QUERLO CHAT:

The REIT - Real Estate Investment Trusts

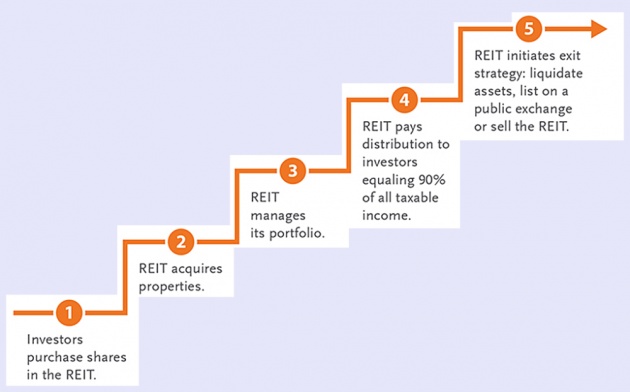

The real estate investing usually requires a significant amount of money, and for many investors, this is the too big amount. The world has already come up with another way of the real estate investing, available to most. These are the real estate investment trusts - REIT.

As standard funds invest in shares, these trusts invest in real estate companies, in the companies whose main business is to build, develop real estate property objects, manage them, lease the premises, and the main income stream to get from rental income.

Real Estate Investment Trusts - Photo credit: griffincapital.com

Most major real estate investment trusts have been released its own shares that are traded in New York, London, Frankfurt, and other stock exchanges - depending on which region the trust works. Most of the shares in such companies can be purchased by each of us, just like ordinary shares traded on the stock exchange, through a commonly used intermediary or directly on the stock exchange.

How the Real Estate Investment Trusts Earn Profit?

What are the main sources of the profit for such companies? The main source is an income from the real estate rental. Such companies can have office buildings, warehouses, residential buildings, and get an income from the renting this property. Part of the revenue is intended to cover administrative expenses - to pay salaries to trusts' managers, expenses for advertising, updates, etc. But the most part of the revenue remains for the investors as a source of profit. Profit is paid to the shareholders of the company at the end of the year.

Get Profit of Real estate Investing - Photo credit: nreionline.com

The second source is the increase in the value of the real estate. Historically, it is calculated that the average profitability of the rent ranges from 4 to 8 percent.

Most of those companies work with borrowed money. They have own capital but additionally are borrowing money also. Loan money has both advantages and disadvantages. If everything is good, and a company borrowed for 3% and manages to earn 6%, it can boost their earnings. However, in the event of a crisis, that cash flow is decreasing and interest is still needed for the bank to pay. Greater debt can also be the cause of bankruptcy.

The general offer is to look at the companies that use less borrowed funds.

How Much Can You Earn and Lose With Real Estate Investing?

Analyzing different investment periods, we can notice a very similar situation as in the case of investing in shares. Investing in real estate companies, the result for the one year could range from -50 to +100 and more.

Within five years there were periods that were loss-making, but with the investment of ten, twenty years, the probability, that the return will be positive, is large enough, and it is approaching a long-term average that seeks 10-11 percent.

Investment in Real Estate - Photo credit: blog.mogi.vn

On the Final Note

The real estate investing seems simple at first glance. Different types of real estate have different risks. When purchasing a real estate, attention must be paid to such nuances as asset valuation, acquisition financing, leverage, asset liquidity, and the factors that determine its price.

Investments in real estate may take different forms - it is not limited to the acquisition of the real estate. You need to be very knowledgeable about the real estate investing so that the premises you have bought would not ultimately go to the loan provider bank.

Investment in Real Estate - Photo credit:arrowbcd.com/blog

When it comes to the real estate investing, it is necessary to know that the main source of profit for which it would be worthwhile to choose such investment is an are income from the real estate rental. The second source is a long-term increase in property value. Adding these two profit sources, you can expect about 8-10 percent annual return over a long period of time if you do not use borrowed funds. For those, who invest only in stocks or bonds, it would be worth considering to invest 10-20% of the investment portfolio to any of alternative investment vehicles.

Experienced investors value real estate as a reliable, profitable, and risk-reducing investment, and therefore, the immovable property is an important part of an investment portfolio.

Real Estate Investing - Photo credit: homerez.com

Real estate is an alternative investment requiring specific knowledge, but the return on real estate is attracting many investors. After all, real estate management gives a social status - not everyone can boast that they have some apartments in the center of the city, but everyone can understand how much they are worth.

Real estate investing, even on a very small scale, remains a tried and true means of building an individual's cash flow and wealth. Robert Kiyosaki

Credit: brainyquote.com

I hope, you find useful my blogs about money investing. And if you ever decide invest in any investment type, I wish you much success!

*************************************************************************************************

Thank you for stopping by and reading my blog.

2018, All Rights Reserved.

You are very welcome to join Bitlanders and share your valuable knowledge and opinion.

***************************************************************************************************

You can check my other blog about investing:

1. The Basics of Investing: First Lesson - What is Money Investing?

2. The Basics of Investing: Second Lesson - Profit and Risk

3. The Basics of Investing: Third Lesson - Bonds

4. The Basics of Investing: Fourth Lesson - Stock

5. The Basics of Investing: Fifth Lesson - Investment Fund

Come back to find more...

**************************************************************************************************