Have you read my Q&A articles on buying condominiums in the Philippines? If not, please read Part 1 here and Part 2 here. If you already know both then now you will know the usual process of purchasing condominiums here in the Philippines.

I have broken the procedure down to 10 steps. It may or may not always be like this. It can change depending on the property, the developer or you and your agent/broker. Generally this is how the condo buying process works.

Are you ready? Let's start!

(Photo credit: ArtGirl via Bitlanders)

(Photo credit: ArtGirl via Bitlanders)

TL;DR:

- Step 1: Get in touch with a real estate agent or broker.

- Step 2: Set an appointment with the agent/broker to do a property/site visit.

- Step 3: Decide on which unit to live or invest in.

- Step 4: Decide and avail the best payment term based on your finances.

- Step 5: Pay the reservation fee (RF) once your decision is final.

- Step 6: Provide the required identification documents.

- Step 7: Fill in the required forms and sign buyer documents.

- Step 8: Prepare your payment/s based on your chosen payment term.

- Step 9: Ask for two important documents from your agent/broker.

- Step 10: Expect to get the Contract To Sell (CTS) and Deed of Absolute Sale (DAS).

Here are the details of the step by step process:

♦ Step 1: Get in touch with a real estate agent or broker.

This is the very first thing you need to do. Before social media was popular, the usual route would be to ask your have friends or relatives if they can refer anyone they can buy a property from. Now it is easier to crowdsource for an agent/broker, just go online and click, click, click.

Do a bit of research then contact any of the suggested agents/brokers or those you found and ask for an appointment. Or if you happen to pass by a mall booth with in-house agents that's fine too.

(Photo credit via Pixabay)

(Photo credit via Pixabay)

♦ Step 2: Set an appointment with the agent/broker to do a property/site visit.

When you contact your chosen agent/broker, set an appointment on when they can discuss the property with you. You can choose to meet directly at the site or sales office, have them go to your office or meet at a coffee shop. It depends on what you both agree on but usually it is best to meet at the property you are interested in.

You can also try to look for online information on the property you are interested in first before contacting an agent. This is so you will know if it is still in the pre-selling stage or if it's already ready for occupancy (RFO). In case you decide to drop by the place itself without any appointment, you will get the assigned real estate agent of the day to assist you.

(Photo credit via Pixabay)

(Photo credit via Pixabay)

In case you don't have enough time during your first meeting, simply set another appointment with your chosen or assigned agent to go to the property. On the site viewing day, you will be shown the condominium itself or the sales office show room/s.

(Video credit: ArtGirl via Bitlanders)

We will be touring you around the model units and give you an overview of the property with the scale model if it is still in the pre-selling stage. Or you can view the actual units, amenities and more once it is RFO.

♦ Step 3: Decide on which unit to live or invest in.

Before going to the property, you should already have an idea of the basic unit you would like to get. To help you pre-decide, you can read Part 1 of my newbie condo buying guide.

If the property you'd like to buy is a pre-selling one, you will not be toured inside the construction site because it is not safe or open to the public yet. As you can see in the video below, a construction site is not really something you may want to see. Of course anyone is free to check on it outside like what I did below but going inside is really not advisable at this point.

(Video credit: Lucy Stephanie via YouTube)

Most likely you will look at model units to see a sample of how your own future condo unit can look like. Or, for example after you have toured the RFO property and have seen the amenities etc., you can then sit down to discuss more details.

During your meeting with your agent/broker, you can then decide on which specific unit to get. Tell us your requirements. Would you like a home facing the East or the North? Does your spouse prefer to live near the top floor or are you afraid of heights? Do you want a garden unit? How many bedrooms do you need? How about parking slots?

(Photo credit via Pixabay)

(Photo credit via Pixabay)

Should you need more time to think about it after being presented with everything about the condominium, ask your agent for other details. We can answer all your queries regarding the property should you have any concerns about it so you can reserve on the spot.

If you need to go home in order to decide, it's better to also provide your agent a time frame of when the reservation will be made. It is best to let us know immediately if you won't go through with it too. Or let us know after two weeks or a few days of really thinking about it, it's up to you. You can also refer your interested relatives, friends, colleagues instead if you change your mind.

♦ Step 4: Decide and avail the best payment term based on your finances.

Consider who will be paying for the property. Will you have a co-buyer or can you pay for it on your own? Do you have the final say on decision making or would you need to talk to your family or friends first before reserving?

(Photo credit via Pixabay)

(Photo credit via Pixabay)

It's okay to take the time on buying a property. You have to make sure your total income will be enough before you go through with the purchase. Don't be pressured to buy immediately but don't take too long to decide either. You never know if the same unit you've chosen will be bought by someone else the next day. It may sound cliche coming from an agent but it does happen with really good properties.

Depending on the kind of property and the developer, the payment terms available to you may vary. You can choose to pay a condo unit almost in full (cash), pay in deferred term or via monthly amortization (MA).

To give you an idea on how to sort your finances, here's a sample payment term we currently have for The Radiance Manila Bay in Pasay City:

- 20% in 36 months (MA), 80% bank financing or cash

- 10% down, 20% in 35 months, 70% bank financing or cash

- 20% down, 10% in 35 months, 70% bank financing or cash

- 100% in 35 months (deferred payment term)

- Cash in 30, 60 or 90 days

Custom payment terms are available but are always subject for approval. In case you choose the MA option, you should also factor in the current bank interest rates. You have to check if you will be able to pay the mortgage after the last MA.

(Photo credit via Pixabay)

♦ Step 5: Pay the reservation fee (RF) once your decision is final.

Good news! You've realized the property is a very good place to live and invest in, now you will need to pay the RF. You can pay it during your first or second meeting or whenever you are able to make the payment. It is a case to case basis anyway.

The RF will be deducted from the total contract price. This is usually deducted from the first down payment if you did not choose the cash payment term option. Don't forget to get an official receipt (OR) for it too.

♦ Step 6: Provide the required identification documents.

(Photo credit via Pixabay)

(Photo credit via Pixabay)

Now that you've paid the RF, you will also need to provide a photocopy of your government IDs like passport and driver's license. Other documents that will be required will be proof of Tax Identification Number (TIN), proof of billing, marriage license if married, etc.

Make sure to bring your actual IDs and other required documents. The requirements may vary depending on the developer and property you will purchase so ask your agent/broker about it.

Should you decide to you purchase using your company then the corporate documents will be what you should provide.

♦ Step 7: Fill in the required forms and sign buyer documents.

The first forms you will need to fill in would be a Buyer's or Corporate Information Sheet and a Reservation Application. You may need to sign two or three of the same forms for safety and to avoid the hassle of having to sign again if there's any mistake done on the first signed forms. Other documents may follow depending on your needs and the property you will purchase.

Each developer or property may have different terms per property too. Your agent/broker will be the one to provide various forms for you to sign based on what is needed. If you will not be present to sign any of the documents then you must have someone who has a consularized or notarized Special Power of Attorney (SPA) to stand in as your representative. You may need to provide your agent a copy of the SPA or we can provide it for you to sign.

(Photo credit: Pixabay)

Note: Steps 3 to 7 can all be done in one day or meeting.

♦ Step 8: Prepare your payment/s based on your chosen payment term.

Let's say you decided to get a unit at The Residences at The Westin Manila Sonata Place. If you choose a 10-40-50 payment term, that means a 10% spot cash (or check) down payment, 40% in 59 months and 50% cash payment or bank financing for the balance. Based on this example you will be required to provide the following:

- 10% payment within 30 days of reserving.

- 59 post dated checks (PDCs) for MAs, 30 days after providing the down payment.

Also, you should not forget to ask for an acknowledgement receipt for the PDCs and the OR of each payment you make.

If the remaining balance will be paid through a bank loan, make sure to apply for it at least three months before the last MA is paid off. You never know what kind of hassle will come up. It's better to prepare earlier than be late in paying anything.

Note: Prepare to pay for a Mortgage Redemption Insurance (MRI) at the bank where you will take the loan. This is your protection in case you pass away unexpectedly. If you have it, your family will not lose the property and the bank will still be paid.

What you need to submit to the developer would be a Letter of Guarantee (LOG) from the bank in order for the loan to be accepted as your balance payment.

(Photo credit: Pixabay)

(Photo credit: Pixabay)

♦ Step 9: Ask for two important documents from your agent/broker.

Don't forget to ask for the monthly Statement of Accounts and your Payment Schedule. Depending on the property or developer, you should have these because they are important for you to keep track of everything. The documents can be provided by your agent or the developer admin representatives. Both are needed for you to document what you've paid and remember when you should make a payment.

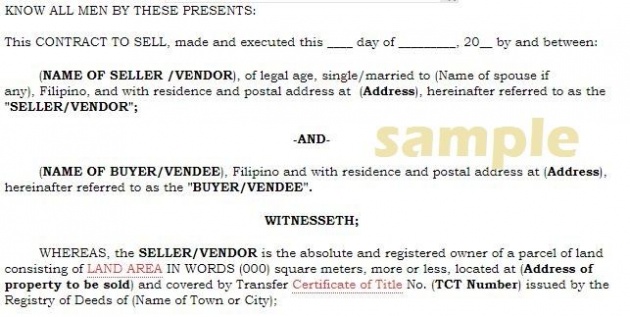

♦ Step 10: Expect to get the Contract To Sell (CTS) and Deed of Absolute Sale (DAS).

A CTS is a contract indicating the developer is agreeing to sell the unit to you and you agree to buy it. It also states that the unit will be delivered to you, or you will fully own it, upon full payment of the total contract price agreed upon.

(Screencap by ArtGirl, credit via legal-forms.philsite.net)

(Screencap by ArtGirl, credit via legal-forms.philsite.net)

The CTS will have to be signed by you, or all the buyer/s, and the developer representative/s. Once done, it has to be notarized before you finally receive it. It can take a few weeks or a month or two before it is delivered or given to you. You should receive it after it has been notarized.

The notarized DAS will also be provided once you have fully paid the condo unit. This is the legal document indicating you are now the owner of the said condo unit once it's been paid in full.

________________________________________________________________

And that's it! You're done with the buying process! Congratulations you would then have your own condo unit!

What else should you expect once you own the condo unit? Read the second part of my newbie condo buying guide.

Are you now ready to reserve and buy a condo unit? Let me know so I can help you out too. (^_^) Questions? Suggestions? Feel free to comment below.

________________________________________________________________

Disclaimer: This article is for general information purposes only. For the exact, complete or specific details always ask your trusted agent/broker before purchasing any condominium unit.

________________________________________________________________

________________________________________________________________

For my other real estate or Philippine related blogs, click below:

- Planning to Purchase a Condominium Unit in the Philippines? Read this Newbie Condo Buying Guide (1 of 2)

- Caritas Manila: A Philippine Charity Worth Donating To

- Shopee PH: Basic Buying and Selling Tips >>> 5 Star blog!

- Grab Philippines: a Mobile App for Public Transportation and Food or Parcel Delivery Convenience

- The World's Oldest Bamboo Organ is in The Philippines! >>> 5 star blog!

To know more about this site, read the FAQ in the gear icon upon signing up.

If you have any problem or site issues,

please report and send an email to cs[at]bitlanders[dot]com.

All images are copyright of their respective owners.

Written for Bitlanders by ArtGirl. All rights reserved

© Art x Stephanie Rue

If you're not a Bitlanders member yet, click here to sign up

and also be appreciated for what you post as you earn extra $$$.